3M 2013 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2013 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

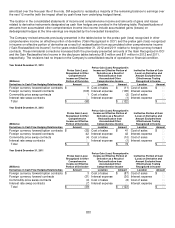

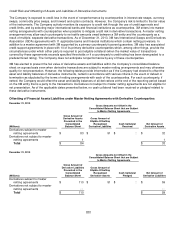

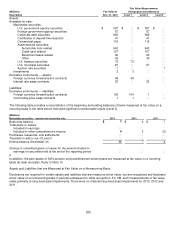

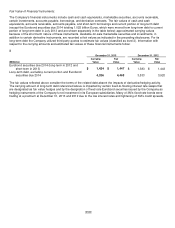

Fair Value Measurements

(Millions) Fair Value at Using Inputs Considered as

Description

Dec. 31, 2012

Level 1

Level 2

Level 3

Assets:

Available-for-sale:

Marketable securities:

U.S. government agency securities $

287

$

―

$

287

$

―

Foreign government agency securities

67

―

67

―

Corporate debt securities

965

―

965

―

Certificates of deposit/time deposits

41

―

41

―

Commercial paper

116

―

116

―

Asset-backed securities:

Automobile loan related

942

―

942

―

Credit card related

157

―

157

―

Equipment lease related

90

―

90

―

Other

39

―

39

―

U.S. treasury securities

72

72

―

―

U.S. municipal securities

27

―

27

―

Auction rate securities

7

―

―

7

Investments

3

3

―

―

Derivative instruments — assets:

Foreign currency forward/option contracts

49

49

―

―

Interest rate swap contracts

23

―

23

―

Liabilities:

Derivative instruments — liabilities:

Foreign currency forward/option contracts

105

104

1

―

Commodity price swap contracts

1

1

―

―

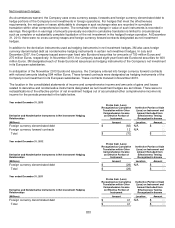

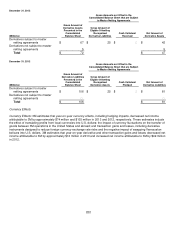

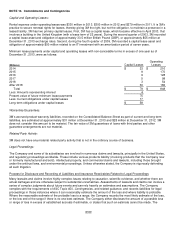

The following table provides a reconciliation of the beginning and ending balances of items measured at fair value on a

recurring basis in the table above that used significant unobservable inputs (Level 3).

(Millions)

Marketable securities – auction rate securities only

2013

2012

2011

Beginning balance

$

7

$

4

$

7

Total gains or losses:

Included in earnings

―

―

―

Included in other comprehensive income

4

3

(3)

Purchases, issuances, and settlements

―

―

―

Transfers in and/or out of Level 3

―

―

―

Ending balance (December 31)

11

7

4

Change in unrealized gains or losses for the period included in

earnings for securities held at the end of the reporting period

―

―

―

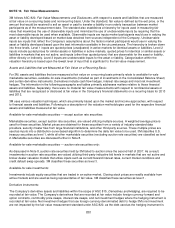

In addition, the plan assets of 3M’s pension and postretirement benefit plans are measured at fair value on a recurring

basis (at least annually). Refer to Note 10.

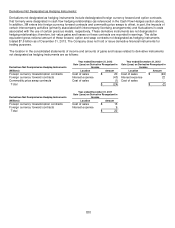

Assets and Liabilities that are Measured at Fair Value on a Nonrecurring Basis:

Disclosures are required for certain assets and liabilities that are measured at fair value, but are recognized and disclosed

at fair value on a nonrecurring basis in periods subsequent to initial recognition. For 3M, such measurements of fair value

relate primarily to long-lived asset impairments. There were no material long-lived asset impairments for 2013, 2012 and

2011.