3M 2013 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2013 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114

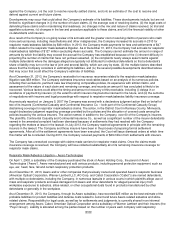

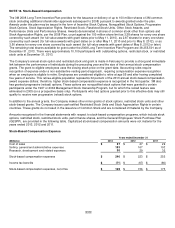

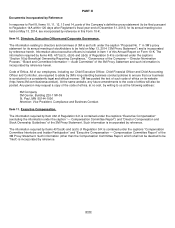

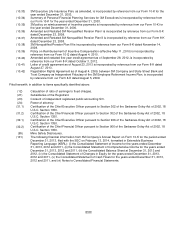

The following table summarizes performance share activity for the years ended December 31:

2013

2012

2011

Weighted

Average

Weighted

Average

Weighted

Average

Number of

Grant Date

Number of

Grant Date

Number of

Grant Date

Awards Fair Value Awards Fair Value

Awards Fair Value

Undistributed balance —

As of January 1

1,089,084

$

79.27

878,872 $

78.55

760,645 $

73.99

Granted

353,734

96.87

467,531 81.55

415,024 84.58

Distributed

(507,083)

75.16

― ―

(206,410) 72.77

Performance change

(6,949)

77.01

(178,838) 81.27

(39,323) 82.10

Forfeited

(33,151)

91.34

(78,481) 80.21

(51,064) 80.20

As of December 31 895,635 $

88.12 1,089,084 $

79.27

878,872 $

78.55

As of December 31, 2013, there was $14 million of compensation expense that has yet to be recognized related to

performance shares. This expense is expected to be recognized over the remaining weighted-average earnings period of

11 months. During the years ended December 31, 2013 and 2011, the total fair value of performance shares that were

distributed were $52 million and $18 million, respectively. The Company’s actual tax benefits realized for the tax

deductions related to the distribution of performance shares for the years ended December 31, 2013 and 2011 was $16

million and $5 million, respectively. There were no performance shares distributed or related tax benefits realized during

the year ended December 31, 2012.

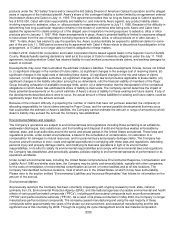

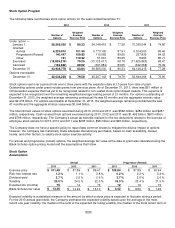

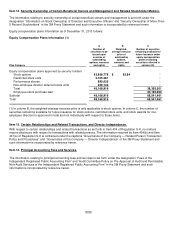

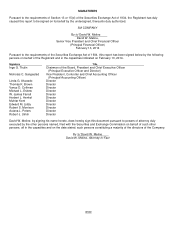

General Employees’ Stock Purchase Plan (GESPP):

As of December 31, 2013, shareholders have approved 60 million shares for issuance under the Company’s GESPP.

Substantially all employees are eligible to participate in the plan. Participants are granted options at 85% of market value

at the date of grant. There are no GESPP shares under option at the beginning or end of each year because options are

granted on the first business day and exercised on the last business day of the same month.

General Employees' Stock Purchase Plan

2013

2012

2011

Weighted

Weighted

Weighted

Average

Average

Average

Shares Exercise Price Shares Exercise Price

Shares Exercise Price

Options granted

1,259,247

$

93.46

1,455,545 $

75.32

1,433,609 $

73.67

Options exercised

(1,259,247)

93.46

(1,455,545) 75.32

(1,433,609) 73.67

Shares available for grant -

December 31 30,185,960 31,445,207 2,900,751

The weighted-average fair value per option granted during 2013, 2012 and 2011 was $16.49, $13.29 and $13.00,

respectively. The fair value of GESPP options was based on the 15% purchase price discount. The Company recognized

compensation expense for GESSP options of $21 million in 2013, $19 million in 2012 and $19 million in 2011.