3M 2013 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2013 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.35

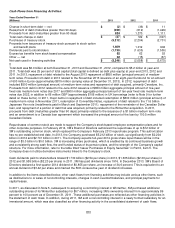

corporate medium-term note securities and other investment-grade fixed income securities, which aggregated to $3.1

billion at December 31, 2013. At December 31, 2012, cash, cash equivalents, and marketable securities held by the

Company’s foreign subsidiaries and the United States totaled approximately $3.7 billion and $2.0 billion, respectively. The

Company’s total balance of cash, cash equivalents and marketable securities was $0.9 billion lower at December 31,

2013 when compared to December 31, 2012. 3M is able to manage the business with lower cash levels, particularly in the

U.S., due to continued business growth and consistently strong cash flow generation. In addition, rising interest rates are

positively impacting 3M’s already well-funded pension status, thereby enabling the Company to reduce the amount of

discretionary contributions to the plans. 3M is planning for added leverage of $2 billion to $4 billion in 2014 as it continues

to improve the efficiency of its capital structure.

3M’s net debt at December 31, 2013 was $1.219 billion, compared to net debt of $308 million at December 31, 2012. At

December 31, 2013, 3M had $4.790 billion of cash, cash equivalents, and marketable securities and $6.009 billion of

debt. Debt included $4.326 billion of long-term debt and $1.683 billion related to the current portion of long-term debt and

other borrowings. The current portion of long-term debt includes a Eurobond due in July 2014 totaling 1.025 billion Euros

($1.424 billion carrying value at December 31, 2013). In August 2013, 3M repaid $850 million (principal amount) of

medium-term notes. In November 2013, 3M issued an eight-year Eurobond for an amount of 600 million Euros

(approximately $815 million carrying value at December 31, 2013). The designated use of proceeds is for general

corporate purposes. The strength of 3M’s capital structure and consistency of its cash flows provide 3M reliable access to

capital markets. Additionally, the Company’s maturity profile is staggered to help ensure refinancing needs in any given

year are reasonable in proportion to the total portfolio. The Company has an AA- credit rating, with a stable outlook, from

Standard & Poor’s and an Aa2 credit rating, with a stable outlook, from Moody’s Investors Service.

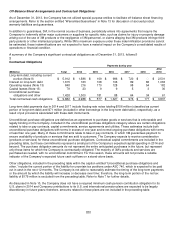

In September 2012, 3M entered into a $1.5 billion, five-year multi-currency revolving credit agreement, which amended

the existing agreement that was entered into in August 2011. This amended agreement extended the expiration date from

August 2016 to September 2017. This credit agreement includes a provision under which 3M may request an increase of

up to $500 million, bringing the total facility up to $2 billion (at the lenders’ discretion). This facility was undrawn at

December 31, 2013. In August 2013, 3M entered into a $150 million, one-year committed letter of credit facility with HSBC

Bank USA, which replaced the one-year $150 million committed credit facility that was entered into in August 2012. As of

December 31, 2013, 3M letters of credit issued under this $150 million committed facility totaled $120 million. In

December 2012, 3M entered into a three-year 66 million British Pound (approximately $106 million based on agreement

date exchange rates) committed credit agreement with JP Morgan Chase Bank, which is fully drawn as of December 31,

2013. Apart from the committed facilities, an additional $51 million in stand-alone letters of credit was also issued and

outstanding at December 31, 2013. The Company also utilized $1 million in international committed lines of credit and $10

million in U.S. committed lines of credit with other banking partners as of December 31, 2013. These lines of credit are

utilized in connection with normal business activities. Under both the $1.5 billion and $150 million credit agreements, the

Company is required to maintain its EBITDA to Interest Ratio as of the end of each fiscal quarter at not less than 3.0 to 1.

This is calculated (as defined in the agreement) as the ratio of consolidated total EBITDA for the four consecutive quarters

then ended to total interest expense on all funded debt for the same period. At December 31, 2013, this ratio was

approximately 55 to 1. Debt covenants do not restrict the payment of dividends.

The Company has a “well-known seasoned issuer” shelf registration statement, effective August 5, 2011, which registers

an indeterminate amount of debt or equity securities for future sales. This replaced 3M’s previous shelf registration dated

February 17, 2009. In September 2011, in connection with the August 5, 2011 shelf registration statement, 3M established

a $3 billion medium-term notes program (Series F), from which 3M issued a five-year $1.0 billion fixed rate note with a

coupon rate of 1.375%. Proceeds were used for general corporate purposes, including repayment in November 2011 of

$800 million (principal amount) of medium-term notes. In June 2012, 3M issued $650 million aggregate principal amount

of five-year fixed rate medium-term notes due 2017 with a coupon rate of 1.000% and $600 million aggregate principal

amount of ten-year fixed rate medium-term notes due 2022 with a coupon rate of 2.000%, which were both issued from

this $3 billion medium-term notes program (Series F). The designated use of proceeds is for general corporate purposes.

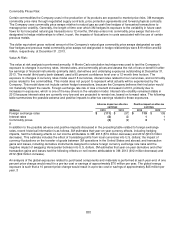

Sources for cash availability in the United States, such as ongoing cash flow from operations and 3M’s reliable access to

capital markets, have historically been sufficient to fund dividend payments to shareholders and share repurchases, in

addition to funding U.S. acquisitions, U.S. capital spending, U.S. pension/other postemployment benefit contributions, and

other items as needed. For those international earnings considered to be reinvested indefinitely, the Company currently

has no plans or intentions to repatriate these funds for U.S. operations. However, if these international funds are needed

for operations in the U.S., 3M would be required to accrue and pay U.S. taxes to repatriate them. Refer to Note 7 for

additional information on unremitted earnings attributable to international companies that have been considered to be

reinvested indefinitely.