3M 2013 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2013 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

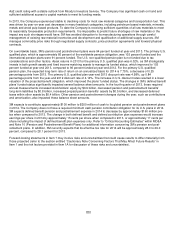

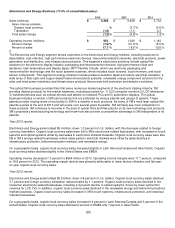

PERFORMANCE BY BUSINESS SEGMENT

Disclosures relating to 3M’s business segments are provided in Item 1, Business Segments. Financial information and

other disclosures are provided in the Notes to the Consolidated Financial Statements. As discussed in Note 15, effective

in the first quarter of 2013, the Company completed a realignment of its business segments to better serve global markets

and customers. Segment information presented herein reflects the impacts of these changes for all periods presented.

The reportable segments are Industrial; Safety and Graphics; Electronics and Energy; Health Care; and Consumer.

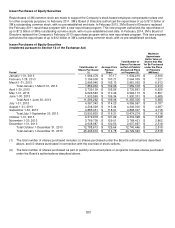

Information related to 3M’s business segments is presented in the tables that follow. Organic local-currency sales include

both organic volume impacts plus selling price impacts. Acquisition impacts, if any, are measured separately for the first

twelve months of the acquisition. The divestiture impacts, if any, foreign currency translation impacts and total sales

change are also provided for each business segment. Any references to EMEA relate to Europe, Middle East and Africa

on a combined basis.

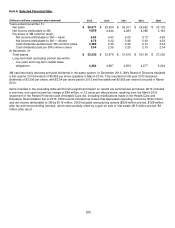

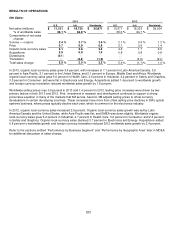

Corporate and Unallocated:

In addition to these five operating business segments, 3M assigns certain costs to “Corporate and Unallocated,” which is

presented separately in the preceding business segments table and in Note 15. Corporate and Unallocated includes a

variety of miscellaneous items, such as corporate investment gains and losses, certain derivative gains and losses,

certain insurance-related gains and losses, certain litigation and environmental expenses, corporate restructuring charges

and certain under- or over-absorbed costs (e.g. pension, stock-based compensation) that the Company may choose not

to allocate directly to its business segments. Because this category includes a variety of miscellaneous items, it is subject

to fluctuation on a quarterly and annual basis.

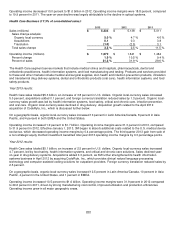

Corporate and Unallocated operating expenses decreased by $149 million in 2013 when compared to 2012. Of the $149

million decrease in 2013, approximately $127 million was due to lower pension and postretirement benefit expense. The

primary items driving the $51 million increase in Corporate and Unallocated in 2012 when compared to 2011 were

pension and postretirement expense, as a portion of the 2012 increase in these expenses were not allocated directly to

the five operating business segments ($63 million), partially offset by an increase in other environmental insurance

receivables, which benefited 2012 by $15 million (as discussed in Note 13).

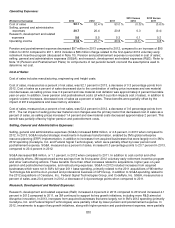

Operating Business Segments:

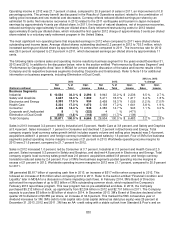

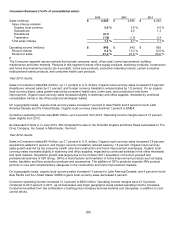

All five business segments, when comparing 2013 to 2012, were impacted by investments in business transformation,

which are enabled by 3M’s global ERP implementation, and by higher allocated pension and postretirement benefit

expenses. The implementation of 3M’s ERP system has increased spending in total, and the transition of 3M’s ERP

system from the development stage into deployment has also resulted in more ERP costs being borne by the five

operating business segments rather than Corporate and Unallocated. This negatively impacted each business segment’s

annual 2013 operating income margins by approximately 0.30 percentage points when compared to 2012. 3M’s pension

and postretirement benefit expenses declined $97 million when comparing 2013 to 2012; however, $127 million of this

reduction was allocated to Corporate and Unallocated, resulting in $30 million of additional expense being absorbed by

the five operating business segments in 2013, or a negative year-on-year impact of approximately 0.10 percentage points.

Thus, while operating income margins have declined when comparing 2013 to 2012 for all five business segments, on

average approximately 0.40 percentage points of this decline relates to the impact of higher ERP implementation

expenses and higher pension and postretirement benefit expenses. When comparing 2012 to 2011, operating business

segment results reflect $32 million in higher year-on-year pension and postretirement benefit expenses.

The following discusses total year results for 2013 compared to 2012, and also discusses 2012 compared to 2011, for

each business segment.