3M 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

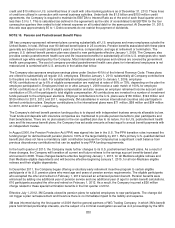

cash pension contribution obligation for its U.S. plans in 2014. Therefore, the amount of the anticipated discretionary

contribution could vary significantly depending on the U.S. plans’ funded status and the anticipated tax deductibility of the

contribution. Future contributions will also depend on market conditions, interest rates and other factors.

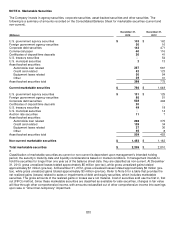

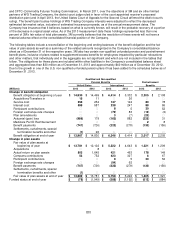

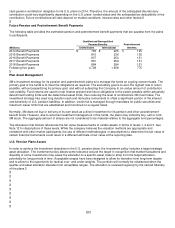

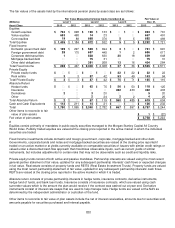

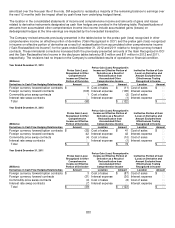

Future Pension and Postretirement Benefit Payments

The following table provides the estimated pension and postretirement benefit payments that are payable from the plans

to participants.

Qualified and Non-qualified

Pension Benefits

Postretirement

(Millions)

United States

International

Benefits

2014 Benefit Payments

$

782 $

225 $ 125

2015 Benefit Payments

810 236 135

2016 Benefit Payments

837 254 151

2017 Benefit Payments

861 259 151

2018 Benefit Payments

884 284 151

Following five years

4,729 1,658 775

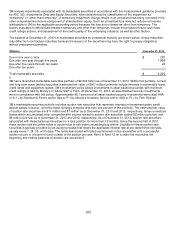

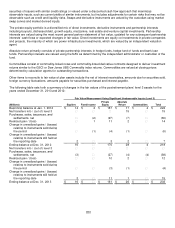

Plan Asset Management

3M’s investment strategy for its pension and postretirement plans is to manage the funds on a going-concern basis. The

primary goal of the funds is to meet the obligations as required. The secondary goal is to earn the highest rate of return

possible, without jeopardizing its primary goal, and without subjecting the Company to an undue amount of contribution

rate volatility. Fund returns are used to help finance present and future obligations to the extent possible within actuarially

determined funding limits and tax-determined asset limits, thus reducing the level of contributions 3M must make. The

investment strategy has used long duration cash and derivative instruments to offset a significant portion of the interest

rate sensitivity of U.S. pension liabilities. In addition, credit risk is managed through mandates for public securities and

maximum issuer limits that are established and monitored on a regular basis.

Normally, 3M does not buy or sell any of its own stock as a direct investment for its pension and other postretirement

benefit funds. However, due to external investment management of the funds, the plans may indirectly buy, sell or hold

3M stock. The aggregate amount of shares are not considered to be material relative to the aggregate fund percentages.

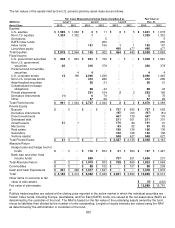

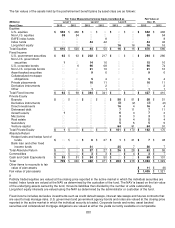

The discussion that follows references the fair value measurements of certain assets in terms of levels 1, 2 and 3. See

Note 12 for descriptions of these levels. While the company believes the valuation methods are appropriate and

consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of

certain financial instruments could result in a different estimate of fair value at the reporting date.

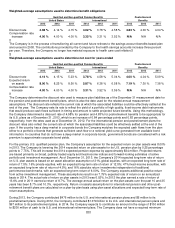

U.S. Pension Plans Assets

In order to achieve the investment objectives in the U.S. pension plans, the investment policy includes a target strategic

asset allocation. The investment policy allows some tolerance around the target in recognition that market fluctuations and

illiquidity of some investments may cause the allocation to a specific asset class to stray from the target allocation,

potentially for long periods of time. Acceptable ranges have been designed to allow for deviation from long-term targets

and to allow for the opportunity for tactical over- and under-weights. The portfolio will normally be rebalanced when the

quarter-end asset allocation deviates from acceptable ranges. The allocation is reviewed regularly by the named fiduciary

of the plans.