3M 2013 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2013 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

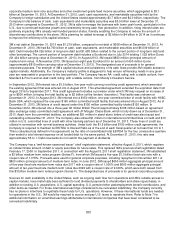

Off-Balance Sheet Arrangements and Contractual Obligations:

As of December 31, 2013, the Company has not utilized special purpose entities to facilitate off-balance sheet financing

arrangements. Refer to the section entitled “Warranties/Guarantees” in Note 13 for discussion of accrued product

warranty liabilities and guarantees.

In addition to guarantees, 3M, in the normal course of business, periodically enters into agreements that require the

Company to indemnify either major customers or suppliers for specific risks, such as claims for injury or property damage

arising out of the use of 3M products or the negligence of 3M personnel, or claims alleging that 3M products infringe third-

party patents or other intellectual property. While 3M’s maximum exposure under these indemnification provisions cannot

be estimated, these indemnifications are not expected to have a material impact on the Company’s consolidated results of

operations or financial condition.

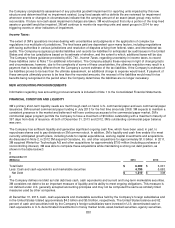

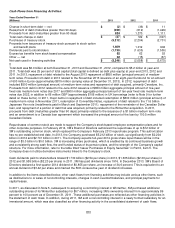

A summary of the Company’s significant contractual obligations as of December 31, 2013, follows:

Contractual Obligations

Payments due by year

After

(Millions)

Total

2014 2015 2016 2017

2018

2018

Long-term debt, including current

portion (Note 9) $

5,912 $

1,586 $

109

$

996

$

720 $

― $

2,501

Interest on long-term debt 1,615 163 108

106

89 86 1,063

Operating leases (Note 13) 848

216 170

128

98 54 182

Capital leases (Note 13) 79 23 9

9

5 3 30

Unconditional purchase

obligations and other 1,428 1,000 181

88

64 34 61

Total contractual cash obligations $

9,882

$

2,988 $

577

$

1,327

$

976 $

177 $

3,837

Long-term debt payments due in 2014 and 2017 include floating rate notes totaling $156 million (classified as current

portion of long-term debt) and $71 million (included in other borrowings in the long-term debt table), respectively, as a

result of put provisions associated with these debt instruments.

Unconditional purchase obligations are defined as an agreement to purchase goods or services that is enforceable and

legally binding on the Company. Included in the unconditional purchase obligations category above are certain obligations

related to take or pay contracts, capital commitments, service agreements and utilities. These estimates include both

unconditional purchase obligations with terms in excess of one year and normal ongoing purchase obligations with terms

of less than one year. Many of these commitments relate to take or pay contracts, in which 3M guarantees payment to

ensure availability of products or services that are sold to customers. The Company expects to receive consideration

(products or services) for these unconditional purchase obligations. Contractual capital commitments are included in the

preceding table, but these commitments represent a small part of the Company’s expected capital spending in 2014 and

beyond. The purchase obligation amounts do not represent the entire anticipated purchases in the future, but represent

only those items for which the Company is contractually obligated. The majority of 3M’s products and services are

purchased as needed, with no unconditional commitment. For this reason, these amounts will not provide a reliable

indicator of the Company’s expected future cash outflows on a stand-alone basis.

Other obligations, included in the preceding table within the caption entitled “Unconditional purchase obligations and

other,” include the current portion of the liability for uncertain tax positions under ASC 740, which is expected to be paid

out in cash in the next 12 months. The Company is not able to reasonably estimate the timing of the long-term payments

or the amount by which the liability will increase or decrease over time; therefore, the long-term portion of the net tax

liability of $179 million is excluded from the preceding table. Refer to Note 7 for further details.

As discussed in Note 10, the Company does not have a required minimum cash pension contribution obligation for its

U.S. plans in 2014 and Company contributions to its U.S. and international pension plans are expected to be largely

discretionary in future years; therefore, amounts related to these plans are not included in the preceding table.