3M 2013 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2013 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

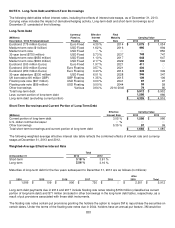

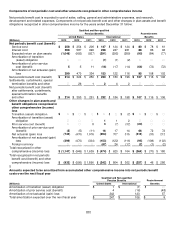

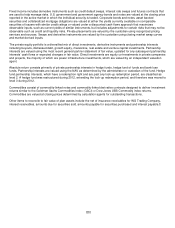

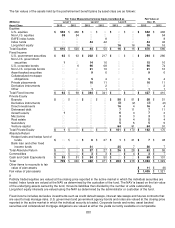

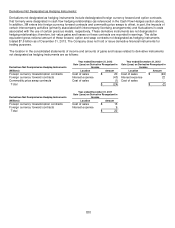

The following table sets forth a summary of changes in the fair values of the U.S. pension plans’ level 3 assets for the

years ended December 31, 2013 and 2012:

Fair Value Measurement Using Significant Unobservable Inputs (Level 3)

Equities

Fixed Income

Private

Equity

Absolute

Return

Commodities

Total (Millions)

Beginning balance at Jan. 1, 2012

$

442 $ 74

$

2,062 $ 520

$

105

$

3,203

Net transfers into / (out of) level 3

― (5) ― 472 ― 467

Purchases, sales, issuances, and

settlements, net

(1) (73) (108) (225) ― (407)

Realized gain / (loss)

― 25 120 76 ― 221

Change in unrealized gains / (losses)

relating to instruments sold during

the period

(1) (19) (3) (49) (1) (73)

Change in unrealized gains / (losses)

relating to instruments still held at

the reporting date

43 ― 65 71 3 182

Ending balance at Dec. 31, 2012

483 2 2,136 865 107 3,593

Net transfers into / (out of) level 3

― ― ― ― ― ―

Purchases, sales, issuances, and

settlements, net

(92) ― 54 (104) (96) (238)

Realized gain / (loss)

10 ― 126 45 (1) 180

Change in unrealized gains / (losses)

relating to instruments sold during

the period

(5) ― 3 (30) (10) (42)

Change in unrealized gains / (losses)

relating to instruments still held at

the reporting date

68 ― 108 (18) ― 158

Ending balance at Dec. 31, 2013

$

464 $ 2

$

2,427 $ 758

$

―

$

3,651

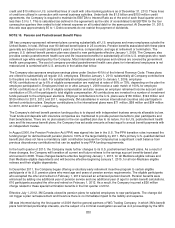

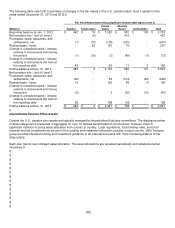

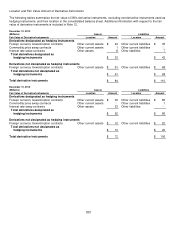

International Pension Plans Assets

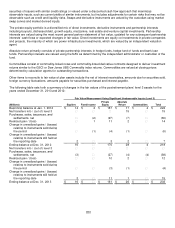

Outside the U.S., pension plan assets are typically managed by decentralized fiduciary committees. The disclosure below

of asset categories is presented in aggregate for over 70 defined benefit plans in 24 countries; however, there is

significant variation in policy asset allocation from country to country. Local regulations, local funding rules, and local

financial and tax considerations are part of the funding and investment allocation process in each country. 3M’s Treasury

group provides standard funding and investment guidance to all international plans with more focused guidance to the

larger plans.

Each plan has its own strategic asset allocation. The asset allocations are reviewed periodically and rebalanced when

necessary.