3M 2013 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2013 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.97

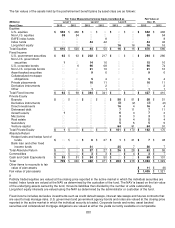

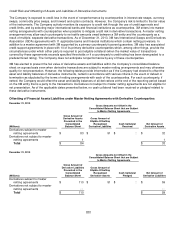

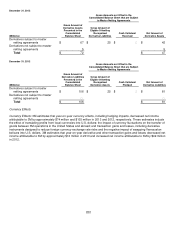

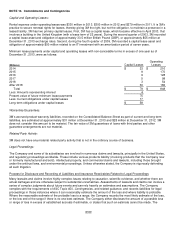

NOTE 12. Fair Value Measurements

3M follows ASC 820, Fair Value Measurements and Disclosures, with respect to assets and liabilities that are measured

at fair value on a recurring basis and nonrecurring basis. Under the standard, fair value is defined as the exit price, or the

amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market

participants as of the measurement date. The standard also establishes a hierarchy for inputs used in measuring fair

value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the

most observable inputs be used when available. Observable inputs are inputs market participants would use in valuing the

asset or liability developed based on market data obtained from sources independent of the Company. Unobservable

inputs are inputs that reflect the Company’s assumptions about the factors market participants would use in valuing the

asset or liability developed based upon the best information available in the circumstances. The hierarchy is broken down

into three levels. Level 1 inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities. Level 2

inputs include quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or

liabilities in markets that are not active, and inputs (other than quoted prices) that are observable for the asset or liability,

either directly or indirectly. Level 3 inputs are unobservable inputs for the asset or liability. Categorization within the

valuation hierarchy is based upon the lowest level of input that is significant to the fair value measurement.

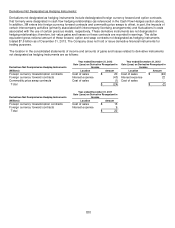

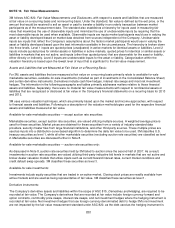

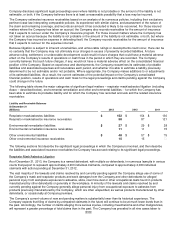

Assets and Liabilities that are Measured at Fair Value on a Recurring Basis:

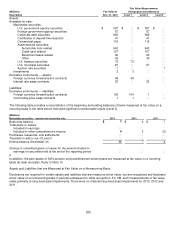

For 3M, assets and liabilities that are measured at fair value on a recurring basis primarily relate to available-for-sale

marketable securities, available-for-sale investments (included as part of investments in the Consolidated Balance Sheet)

and certain derivative instruments. Derivatives include cash flow hedges, interest rate swaps and most net investment

hedges. The information in the following paragraphs and tables primarily addresses matters relative to these financial

assets and liabilities. Separately, there were no material fair value measurements with respect to nonfinancial assets or

liabilities that are recognized or disclosed at fair value in the Company’s financial statements on a recurring basis for 2013

and 2012.

3M uses various valuation techniques, which are primarily based upon the market and income approaches, with respect

to financial assets and liabilities. Following is a description of the valuation methodologies used for the respective financial

assets and liabilities measured at fair value.

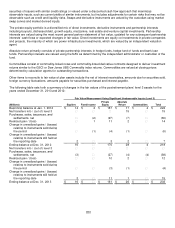

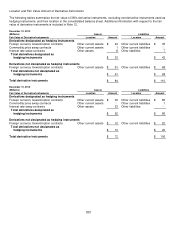

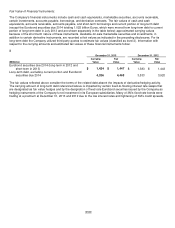

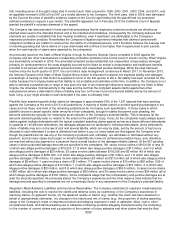

Available-for-sale marketable securities — except auction rate securities:

Marketable securities, except auction rate securities, are valued utilizing multiple sources. A weighted average price is

used for these securities. Market prices are obtained for these securities from a variety of industry standard data

providers, security master files from large financial institutions, and other third-party sources. These multiple prices are

used as inputs into a distribution-curve-based algorithm to determine the daily fair value to be used. 3M classifies U.S.

treasury securities as level 1, while all other marketable securities (excluding auction rate securities) are classified as level

2. Marketable securities are discussed further in Note 8.

Available-for-sale marketable securities — auction rate securities only:

As discussed in Note 8, auction rate securities held by 3M failed to auction since the second half of 2007. As a result,

investments in auction rate securities are valued utilizing third-party indicative bid levels in markets that are not active and

broker-dealer valuation models that utilize inputs such as current/forward interest rates, current market conditions and

credit default swap spreads. 3M classifies these securities as level 3.

Available-for-sale investments:

Investments include equity securities that are traded in an active market. Closing stock prices are readily available from

active markets and are used as being representative of fair value. 3M classifies these securities as level 1.

Derivative instruments:

The Company’s derivative assets and liabilities within the scope of ASC 815, Derivatives and Hedging, are required to be

recorded at fair value. The Company’s derivatives that are recorded at fair value include foreign currency forward and

option contracts, commodity price swaps, interest rate swaps, and net investment hedges where the hedging instrument is

recorded at fair value. Net investment hedges that use foreign currency denominated debt to hedge 3M’s net investment

are not impacted by the fair value measurement standard under ASC 820, as the debt used as the hedging instrument is