United Healthcare 2012 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2012 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

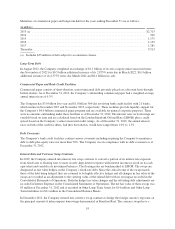

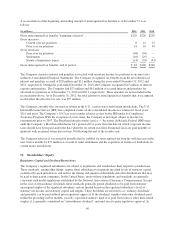

2012, based on the 2011 statutory net income and statutory capital and surplus levels, the maximum amount of

ordinary dividends that could have been paid by the Company’s U.S. regulated subsidiaries to their parent

companies was $4.6 billion.

For the year ended December 31, 2012, the Company’s regulated subsidiaries paid their parent companies

dividends of $4.9 billion, including $1.2 billion of extraordinary dividends. For the year ended December 31,

2011, the Company’s regulated subsidiaries paid their parent companies dividends of $4.5 billion, including

$1.1 billion of extraordinary dividends. As of December 31, 2012, $1.1 billion of the Company’s $8.4 billion of

cash and cash equivalents was held by non-regulated entities.

The Company’s regulated subsidiaries had estimated aggregate statutory capital and surplus of approximately

$13 billion as of December 31, 2012; regulated entity statutory capital exceeded aggregate minimum capital

requirements.

Optum Bank must meet minimum requirements for Tier 1 leverage capital, Tier 1 risk-based capital, and Total

risk-based capital of the Federal Deposit Insurance Corporation (FDIC) to be considered “Well Capitalized”

under the capital adequacy rules to which it is subject. At December 31, 2012, the Company believes that Optum

Bank met the FDIC requirements to be considered “Well Capitalized.”

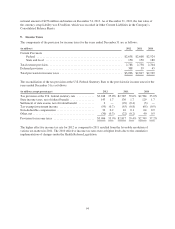

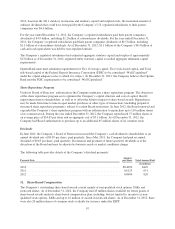

Share Repurchase Program

Under its Board of Directors’ authorization, the Company maintains a share repurchase program. The objectives

of the share repurchase program are to optimize the Company’s capital structure and cost of capital, thereby

improving returns to shareholders, as well as to offset the dilutive impact of share-based awards. Repurchases

may be made from time to time in open market purchases or other types of transactions (including prepaid or

structured share repurchase programs), subject to certain Board restrictions. In June 2012, the Board renewed and

expanded the Company’s share repurchase program with an authorization to repurchase up to 110 million shares

of its common stock. During the year ended December 31, 2012, the Company repurchased 57 million shares at

an average price of $54.45 per share and an aggregate cost of $3.1 billion. As of December 31, 2012, the

Company had Board authorization to purchase up to an additional 85 million shares of its common stock.

Dividends

In June 2012, the Company’s Board of Directors increased the Company’s cash dividend to shareholders to an

annual dividend rate of $0.85 per share, paid quarterly. Since May 2011, the Company had paid an annual

dividend of $0.65 per share, paid quarterly. Declaration and payment of future quarterly dividends is at the

discretion of the Board and may be adjusted as business needs or market conditions change.

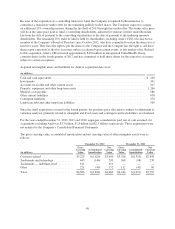

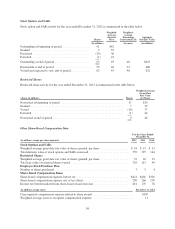

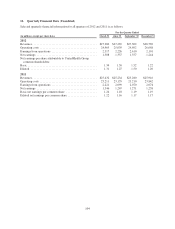

The following table provides details of the Company’s dividend payments:

Payment Date

Amount

per Share Total Amount Paid

(in millions)

2010 ............................................................... $0.4050 $449

2011 ............................................................... 0.6125 651

2012 ............................................................... 0.8000 820

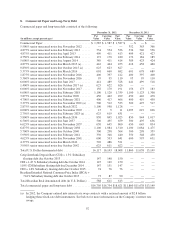

11. Share-Based Compensation

The Company’s outstanding share-based awards consist mainly of non-qualified stock options, SARs and

restricted shares. As of December 31, 2012, the Company had 43 million shares available for future grants of

share-based awards under its share-based compensation plan, including, but not limited to, incentive or non-

qualified stock options, SARs and up to 16 million of awards in restricted shares. As of December 31, 2012, there

were also 20 million shares of common stock available for issuance under the ESPP.

97