United Healthcare 2012 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2012 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Long-term debt. Periodically, we access capital markets and issue long-term debt for general corporate purposes,

for example, to meet our working capital requirements, to refinance debt, to finance acquisitions or for share

repurchases.

In connection with the Amil acquisition, we assumed variable rate debt denominated in Brazilian Reais, Amil’s

functional currency. The total Brazilian Real denominated long-term debt outstanding at December 31, 2012 was

$611 million, and had an aggregate weighted average interest rate of approximately 9%. For more detail on the

Amil debt see Note 8 of Notes to the Consolidated Financial Statements included in Item 8, “Financial

Statements.”

In October 2012, we issued $2.5 billion in senior unsecured notes, which included: $625 million of 0.850%

fixed-rate notes due October 2015, $625 million of 1.400% fixed-rate notes due October 2017, $625 million of

2.750% fixed-rate notes due February 2023 and $625 million of 3.950% fixed-rate notes due October 2042.

In August 2012, we completed an exchange of $1.1 billion of our zero coupon senior unsecured notes due

November 2022 for $0.5 billion additional issuance of our 2.875% notes due in March 2022, $0.1 billion

additional issuance of our 4.375% notes due March 2042 and $0.1 billion in cash. The transaction was

undertaken to increase financial flexibility and reduce interest expense.

In March 2012, we issued $1.0 billion in senior unsecured notes. The issuance included $600 million of 2.875%

fixed-rate notes due March 2022 and $400 million of 4.375% fixed-rate notes due March 2042.

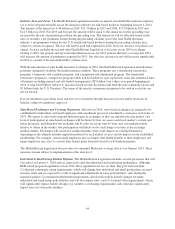

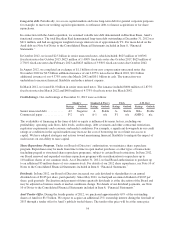

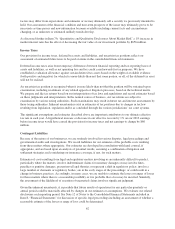

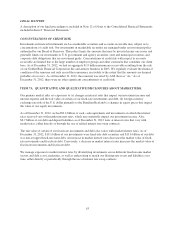

Credit Ratings. Our credit ratings at December 31, 2012 were as follows:

Moody’s Standard & Poor’s Fitch A.M. Best

Ratings Outlook Ratings Outlook Ratings Outlook Ratings Outlook

Senior unsecured debt ........... A3 Negative A Stable A- Stable bbb+ Stable

Commercial paper .............. P-2 n/a A-1 n/a F1 n/a AMB-2 n/a

The availability of financing in the form of debt or equity is influenced by many factors, including our

profitability, operating cash flows, debt levels, credit ratings, debt covenants and other contractual restrictions,

regulatory requirements and economic and market conditions. For example, a significant downgrade in our credit

ratings or conditions in the capital markets may increase the cost of borrowing for us or limit our access to

capital. We have adopted strategies and actions toward maintaining financial flexibility to mitigate the impact of

such factors on our ability to raise capital.

Share Repurchase Program. Under our Board of Directors’ authorization, we maintain a share repurchase

program. Repurchases may be made from time to time in open market purchases or other types of transactions

(including prepaid or structured share repurchase programs), subject to certain Board restrictions. In June 2012,

our Board renewed and expanded our share repurchase program with an authorization to repurchase up to

110 million shares of our common stock. As of December 31, 2012, we had Board authorization to purchase up

to an additional 85 million shares of our common stock. For details of our 2012 share repurchases, see Note 10 of

Notes to the Consolidated Financial Statements included in Item 8, “Financial Statements.”

Dividends. In June 2012, our Board of Directors increased our cash dividend to shareholders to an annual

dividend rate of $0.85 per share, paid quarterly. Since May 2011, we had paid an annual dividend of $0.65 per

share, paid quarterly. Declaration and payment of future quarterly dividends is at the discretion of the Board and

may be adjusted as business needs or market conditions change. For details of our dividend payments, see Note

10 of Notes to the Consolidated Financial Statements included in Item 8, “Financial Statements.”

Amil Tender Offer. During the fourth quarter of 2012, we purchased approximately 65% of the outstanding

shares of Amil for $3.5 billion. We expect to acquire an additional 25% ownership interest during the first half of

2013 through a tender offer for Amil’s publicly traded shares. The tender offer price will be at the same price

54