United Healthcare 2012 Annual Report Download - page 82

Download and view the complete annual report

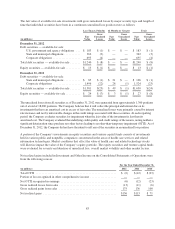

Please find page 82 of the 2012 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.a straight-line basis over the related service period (generally the vesting period) of the award, or to an

employee’s eligible retirement date under the award agreement, if earlier. Restricted shares vest ratably,

primarily over three to four years and compensation expense related to restricted shares is based on the share

price on date of grant. Stock options and SARs vest ratably over four to six years and may be exercised up to

10 years from the date of grant. Compensation expense related to stock options and SARs is based on the fair

value at date of grant, which is estimated on the date of grant using a binomial option-pricing model. Under the

Company’s Employee Stock Purchase Plan (ESPP) eligible employees are allowed to purchase the Company’s

stock at a discounted price, which is 85% of the lower market price of the Company’s common stock at the

beginning or at the end of the six-month purchase period. Share-based compensation expense for all programs is

recognized in Operating Costs in the Company’s Consolidated Statements of Operations.

Net Earnings Per Common Share

The Company computes basic net earnings per common share by dividing net earnings by the weighted-average

number of common shares outstanding during the period. The Company determines diluted net earnings per

common share using the weighted-average number of common shares outstanding during the period, adjusted for

potentially dilutive shares associated with stock options, SARs, restricted shares and the ESPP, using the treasury

stock method. The treasury stock method assumes a hypothetical issuance of shares to settle the share-based

awards, with the assumed proceeds used to purchase common stock at the average market price for the period.

Assumed proceeds include the amount the employee must pay upon exercise, any unrecognized compensation

cost and any related excess tax benefit. The difference between the number of shares assumed issued and number

of shares assumed purchased represents the dilutive shares.

Recently Adopted Accounting Standards

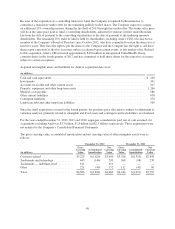

In May 2011, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU)

No. 2011-04, “Fair Value Measurement (Topic 820): Amendments to Achieve Common Fair Value

Measurement and Disclosure Requirements in U.S. GAAP and IFRSs” (ASU 2011-04). This update provides

guidance on how fair value measurement should be applied where existing GAAP already requires or permits fair

value measurements. In addition, ASU 2011-04 requires expanded disclosures regarding fair value

measurements. ASU 2011-04 became effective for the Company’s fiscal year 2012. The adoption of the

measurement guidance of ASU 2011-04 did not have a material impact on the Consolidated Financial

Statements. The new disclosures have been included with the Company’s fair value disclosures in Note 4.

In June 2011, the FASB issued ASU No. 2011-05, “Comprehensive Income (Topic 220) — Presentation of

Comprehensive Income” (ASU 2011-05). ASU 2011-05 requires entities to present the total of comprehensive

income, the components of net income, and the components of other comprehensive income either in a single

continuous statement of comprehensive income or in two separate but consecutive statements and eliminates the

option to present the components of other comprehensive income as a part of the statement of equity. ASU 2011-05

became effective for the Company’s fiscal year 2012. The Company presented separate Consolidated Statements of

Comprehensive Income, which appear consecutive to the Consolidated Statements of Operations.

The Company has determined that there have been no other recently adopted or issued accounting standards that

had or will have a material impact on its Consolidated Financial Statements.

80