United Healthcare 2012 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2012 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Optum. Total revenues increased in 2012 due to business growth and 2011 acquisitions at OptumHealth, partially

offset by a reduction in pharmacy service revenues related to reduced levels of UnitedHealthcare Part D

prescription drug membership and related prescription volumes.

Optum’s earnings from operations and operating margin for 2012 increased compared to 2011 due to

improvements in operating cost structure stemming from advances in business simplification, integration and

overall efficiency and revenue growth in higher margin products.

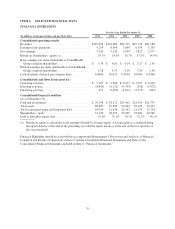

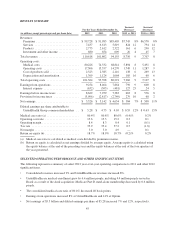

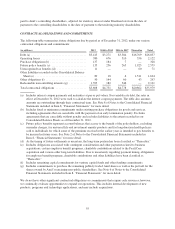

The results by segment were as follows:

OptumHealth

Revenue increases at OptumHealth for 2012 were primarily due to market expansion, including growth related to

2011 acquisitions in integrated care delivery, and strong overall business growth.

Earnings from operations for 2012 and operating margins increased compared to 2011 primarily due to gains in

operating efficiency and cost management as well as increases in earnings from integrated care operations.

OptumInsight

Revenues at OptumInsight for 2012 increased primarily due to the impact of growth in compliance services for

care providers and payment integrity offerings for commercial payers, which was partially offset by the June

2011 divestiture of the clinical trials services business.

The increases in earnings from operations and operating margins for 2012 reflect an improved mix of services

and advances in operating efficiency and cost management.

OptumRx

The decreases in OptumRx revenues in 2012 were due to the reduction in UnitedHealthcare Medicare Part D plan

participants. Intersegment revenues eliminated in consolidation were $15.6 billion for 2012 and $16.7 billion for

2011.

OptumRx earnings from operations and operating margins for 2012 decreased primarily due to decreased

prescription volume in the Medicare Part D business and investments to support growth initiatives, which were

partially offset by earnings contributions from specialty pharmacy growth and greater use of generic medications.

Over the course of 2013, we will consolidate and manage our commercial pharmacy benefit programs from

Express Scripts’ subsidiary, Medco Health Solutions, Inc. As a result of this transition, OptumRx expects to add

approximately12 million members throughout 2013.

2011 RESULTS OF OPERATIONS COMPARED TO 2010 RESULTS

Consolidated Financial Results

Revenues

The increases in revenues for 2011 were driven by strong organic growth in the number of individuals served in

our UnitedHealthcare businesses, commercial premium rate increases reflecting underlying medical cost trends

and revenue growth across all Optum businesses.

Medical Costs

Medical costs for 2011 increased due to risk-based membership growth in our commercial and public and senior

markets businesses and continued increases in the cost per service paid for health system use, and a modest

increase in health system utilization, mainly in outpatient and physician office settings.

49