United Healthcare 2012 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2012 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

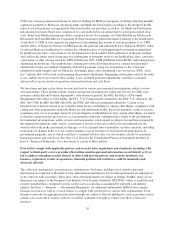

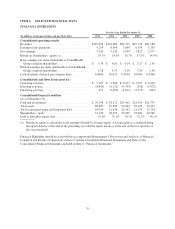

MARKET PRICES

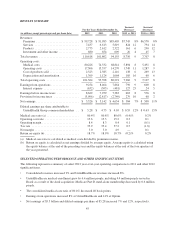

Our common stock is traded on the New York Stock Exchange (NYSE) under the symbol UNH. On January 31,

2013, there were 15,204 registered holders of record of our common stock. The per share high and low common

stock sales prices reported by the NYSE were as follows:

High Low

Cash

Dividends

Declared

2013

First quarter (through February 6, 2013) ................................... $57.83 $51.36 $0.2125

2012

First quarter ......................................................... $59.43 $49.82 $0.1625

Second quarter ....................................................... $60.75 $53.78 $0.2125

Third quarter ........................................................ $59.31 $50.32 $0.2125

Fourth quarter ....................................................... $58.29 $51.09 $0.2125

2011

First quarter ......................................................... $45.75 $36.37 $0.1250

Second quarter ....................................................... $52.64 $43.30 $0.1625

Third quarter ........................................................ $53.50 $41.27 $0.1625

Fourth quarter ....................................................... $51.71 $41.32 $0.1625

DIVIDEND POLICY

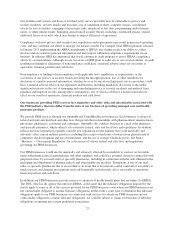

In June 2012, our Board of Directors increased our cash dividend on common stock to an annual dividend rate of

$0.85 per share, paid quarterly. Since May 2011, we had paid an annual cash dividend on common stock of $0.65

per share, distributed quarterly. Declaration and payment of future quarterly dividends is at the discretion of the

Board and may be adjusted as business needs or market conditions change.

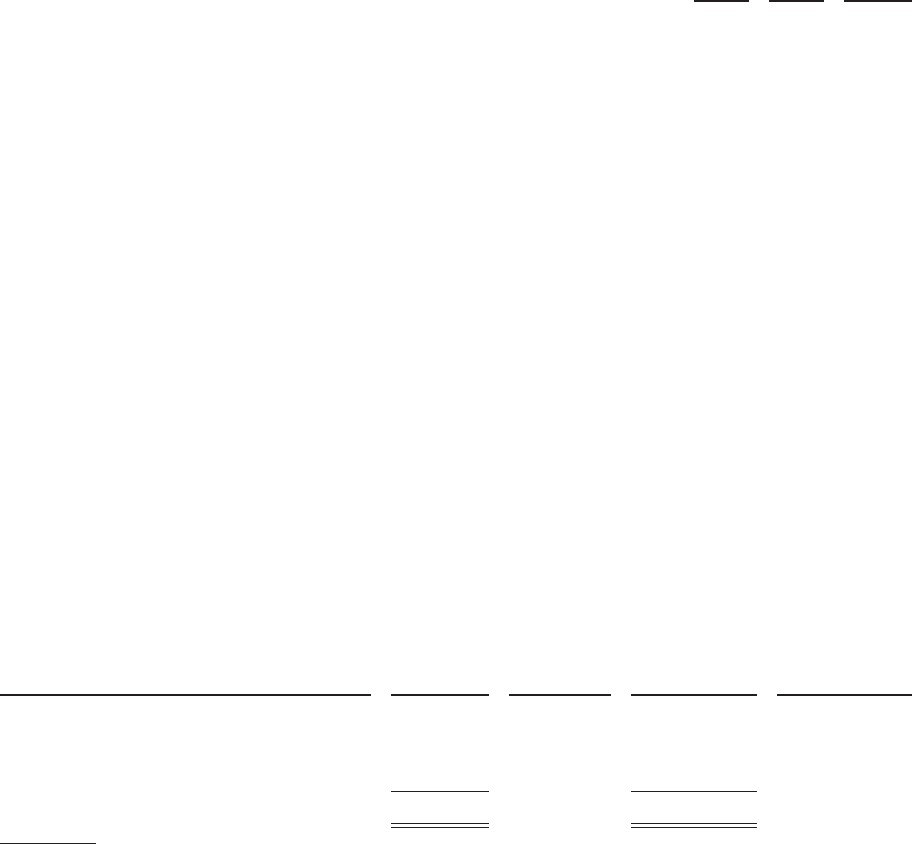

ISSUER PURCHASES OF EQUITY SECURITIES

Issuer Purchases of Equity Securities (a)

Fourth Quarter 2012

For the Month Ended

Total Number

of Shares

Purchased

Average Price

Paid per Share

Total Number of

Shares Purchased

as Part of Publicly

Announced Plans

or Programs

Maximum Number

of Shares That May

Yet Be Purchased

Under The Plans or

Programs

(in millions) (in millions) (in millions)

October 31, 2012 ....................... — $ — — 94

November 30, 2012 ..................... — — — 94

December 31, 2012 ..................... 9 54 9 85

Total ................................ 9 $ 54 9

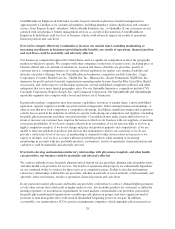

(a) In November 1997, our Board of Directors adopted a share repurchase program, which the Board evaluates

periodically. In June 2012, the Board renewed and expanded our share repurchase program with an

authorization to repurchase up to 110 million shares of our common stock in open market purchases or other

types of transactions (including prepaid or structured repurchase programs). There is no established

expiration date for the program.

35