United Healthcare 2012 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2012 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

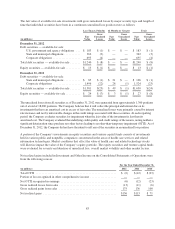

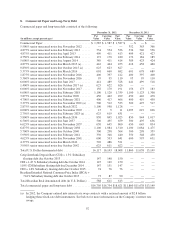

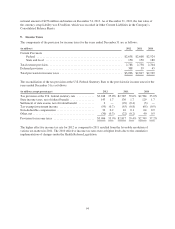

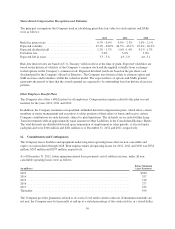

8. Commercial Paper and Long-Term Debt

Commercial paper and long-term debt consisted of the following:

December 31, 2012 December 31, 2011

(in millions, except percentages)

Par

Value

Carrying

Value

Fair

Value

Par

Value

Carrying

Value

Fair

Value

Commercial Paper ................................ $ 1,587 $ 1,587 $ 1,587 $ — $ — $ —

5.500% senior unsecured notes due November 2012 .....———352363366

4.875% senior unsecured notes due February 2013 ...... 534 534 536 534 540 556

4.875% senior unsecured notes due April 2013 ......... 409 411 413 409 421 427

4.750% senior unsecured notes due February 2014 ...... 172 178 180 172 184 185

5.000% senior unsecured notes due August 2014 ........ 389 411 414 389 423 424

4.875% senior unsecured notes due March 2015 (a) ...... 416 444 453 416 458 460

0.850% senior unsecured notes due October 2015 (a) .... 625 623 627———

5.375% senior unsecured notes due March 2016 ........ 601 660 682 601 678 689

1.875% senior unsecured notes due November 2016 ..... 400 397 412 400 397 400

5.360% senior unsecured notes due November 2016 ..... 95 95 110 95 95 110

6.000% senior unsecured notes due June 2017 .......... 441 489 528 441 499 518

1.400% senior unsecured notes due October 2017 (a) .... 625 622 626———

6.000% senior unsecured notes due November 2017 ..... 156 170 191 156 173 183

6.000% senior unsecured notes due February 2018 ...... 1,100 1,120 1,339 1,100 1,123 1,308

3.875% senior unsecured notes due October 2020 ....... 450 442 499 450 442 478

4.700% senior unsecured notes due February 2021 ...... 400 417 466 400 419 450

3.375% senior unsecured notes due November 2021 (a) . . 500 512 533 500 497 517

2.875% senior unsecured notes due March 2022 ........ 1,100 998 1,128———

0.000% senior unsecured notes due November 2022 ..... 15 9 11 1,095 619 696

2.750% senior unsecured notes due February 2023 (a) .... 625 619 631———

5.800% senior unsecured notes due March 2036 ........ 850 845 1,025 850 844 1,017

6.500% senior unsecured notes due June 2037 .......... 500 495 659 500 495 636

6.625% senior unsecured notes due November 2037 ..... 650 645 860 650 645 834

6.875% senior unsecured notes due February 2038 ...... 1,100 1,084 1,510 1,100 1,084 1,475

5.700% senior unsecured notes due October 2040 ....... 300 298 364 300 298 359

5.950% senior unsecured notes due February 2041 ...... 350 348 440 350 348 430

4.625% senior unsecured notes due November 2041 ..... 600 593 641 600 593 631

4.375% senior unsecured notes due March 2042 ........ 502 486 521———

3.950% senior unsecured notes due October 2042 ....... 625 611 622———

Total U.S. Dollar denominated debt .................. 16,117 16,143 18,008 11,860 11,638 13,149

Cetip Interbank Deposit Rate (CDI) + 1.3% Subsidiary

floating debt due October 2013 .................... 147 148 150———

CDI + 1.45 % Subsidiary floating debt due October 2014 . . . 147 149 150———

110% CDI Subsidiary floating debt due December 2014 .... 147 151 147———

CDI + 1.6% Subsidiary floating debt due October 2015 . . . 74 76 76———

Brazilian Extended National Consumer Price Index (IPCA) +

7.61% Subsidiary floating debt due October 2015 ....... 73 87 90———

Total Brazilian Real denominated debt (in U.S. Dollars) . . 588 611 613———

Total commercial paper and long-term debt ............ $16,705 $16,754 $18,621 $11,860 $11,638 $13,149

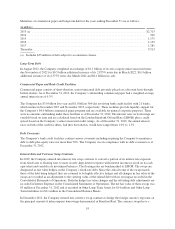

(a) In 2012, the Company entered into interest rate swap contracts with a notional amount of $2.8 billion

hedging these fixed-rate debt instruments. See below for more information on the Company’s interest rate

swaps.

92