United Healthcare 2012 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2012 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

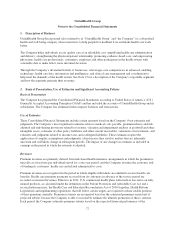

premium payments received in advance of the applicable service period in Unearned Revenues in the

Consolidated Balance Sheets.

The Catastrophic Reinsurance Subsidy and the Low-Income Member Cost Sharing Subsidy (Subsidies) represent

cost reimbursements under the Medicare Part D program. Amounts received for these Subsidies are not reflected

as premium revenues, but rather are accounted for as receivables and/or deposits. Related cash flows are

presented as Customer Funds Administered within financing activities in the Consolidated Statements of Cash

Flows.

Pharmacy benefit costs and administrative costs under the contract are expensed as incurred and are recognized

in Medical Costs and Operating Costs, respectively, in the Consolidated Statements of Operations.

The final 2012 risk-share amount is expected to be settled during the second half of 2013, and is subject to the

reconciliation process with CMS.

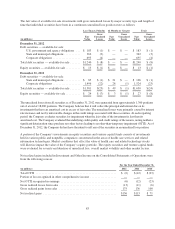

The Consolidated Balance Sheets include the following amounts associated with the Medicare Part D program:

December 31, 2012 December 31, 2011

(in millions) Subsidies Drug Discount Risk-Share Subsidies Drug Discount Risk-Share

Other current receivables .......... $461 $314 $ — $ — $509 $ —

Other policy liabilities ............. — 319 438 70 649 170

As of January 1, 2013, certain changes were made to the Medicare Part D coverage by CMS, including:

The initial coverage limit increased to $2,970 from $2,930 in 2012.

The catastrophic coverage begins at $6,734 as compared to $6,658 in 2012.

The annual out-of-pocket maximum increased to $4,750 from $4,700 in 2012.

The discounts on prescription drugs within the coverage gap increased to 52.5% from 50% in 2012 for

brand name drugs and to 21% from 14% in 2012 for generic drugs.

Property, Equipment and Capitalized Software

Property, equipment and capitalized software are stated at cost, net of accumulated depreciation and

amortization. Capitalized software consists of certain costs incurred in the development of internal-use software,

including external direct costs of materials and services and applicable payroll costs of employees devoted to

specific software development. The Company reviews property, equipment and capitalized software for events or

changes in circumstances that would indicate that it might not recover their carrying value. If the Company

determines that an asset may not be recoverable, an impairment charge is recorded.

The Company calculates depreciation and amortization using the straight-line method over the estimated useful

lives of the assets. The useful lives for property, equipment and capitalized software are:

Furniture, fixtures and equipment ........... 3to7years

Buildings .............................. 35to40years

Leasehold improvements .................. 7years or length of lease term, whichever is shorter

Capitalized software ...................... 3to5years

Goodwill

Goodwill represents the amount of the purchase price in excess of the fair values assigned to the underlying

identifiable net assets of acquired businesses. Goodwill is not amortized, but is subject to an annual impairment

test. Tests are performed more frequently if events occur or circumstances change that would more likely than

not reduce the fair value of the reporting unit below its carrying amount.

77