United Healthcare 2012 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2012 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Income Taxes

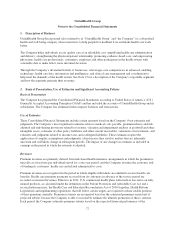

Deferred income tax assets and liabilities are recognized for the differences between the financial and income tax

reporting bases of assets and liabilities based on enacted tax rates and laws. The deferred income tax provision or

benefit generally reflects the net change in deferred income tax assets and liabilities during the year, excluding

any deferred income tax assets and liabilities of acquired businesses. The current income tax provision reflects

the tax consequences of revenues and expenses currently taxable or deductible on various income tax returns for

the year reported.

Future Policy Benefits and Reinsurance Receivable

Future policy benefits represent account balances that accrue to the benefit of the policyholders, excluding surrender

charges, for universal life and investment annuity products and for long-duration health policies sold to individuals

for which some of the premium received in the earlier years is intended to pay benefits to be incurred in future

years. As a result of the 2005 sale of the life and annuity business within the Company’s Golden Rule Financial

Corporation subsidiary under an indemnity reinsurance arrangement, the Company has maintained a liability

associated with the reinsured contracts, as it remains primarily liable to the policyholders, and has recorded a

corresponding reinsurance receivable due from the purchaser. As of December 31, 2012, the Company had an

aggregate $1.9 billion reinsurance receivable, of which $135 million was recorded in Other Current Receivables and

$1.8 billion was recorded in Other Assets in the Consolidated Balance Sheets. As of December 31, 2011, the

Company had an aggregate $1.9 billion reinsurance receivable, of which $125 million was recorded in Other

Current Receivables and $1.8 billion was recorded in Other Assets in the Consolidated Balance Sheets. The

Company evaluates the financial condition of the reinsurer and only records the reinsurance receivable to the extent

of probable recovery. As of December 31, 2012, the reinsurer was rated by A.M. Best as “A+.”

Foreign currency translation

Assets and liabilities of the Company’s foreign operations denominated in non-U.S. dollar functional currencies

are translated into U.S. dollars at current exchange rates as of the end of each accounting period. Related revenue

and expenses are translated at average exchange rates during the accounting period. The gains or losses resulting

from translating foreign currency financial statements into U.S. dollars are included in shareholders’ equity and

comprehensive income.

Noncontrolling interests

Noncontrolling interests in the Company’s subsidiaries whose redemption is outside the control of the Company

are classified as temporary equity. The redeemable noncontrolling interests are primarily related to holders of

Amil Participações S.A. (Amil) shares. Amil was acquired in 2012, see Note 6 for more information. During

2012, the Company purchased noncontrolling interest shares for $319 million, of which $11 million was recorded

as a reduction of Additional Paid-In Capital. For the year ended December 31, 2012, the Company’s net earnings

attributable to redeemable noncontrolling interests was nil and other noncontrolling interest activity was not

material.

Policy Acquisition Costs

The Company’s short duration health insurance contracts typically have a one-year term and may be canceled by

the customer with at least 30 days notice. Costs related to the acquisition and renewal of short duration customer

contracts are charged to expense as incurred.

Share-Based Compensation

The Company recognizes compensation expense for share-based awards, including stock options, stock-settled

stock appreciation rights (SARs) and restricted stock and restricted stock units (collectively, restricted shares), on

79