United Healthcare 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

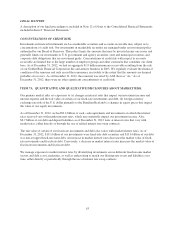

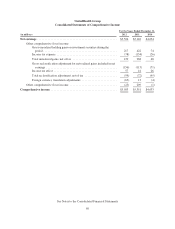

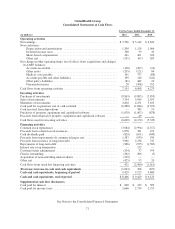

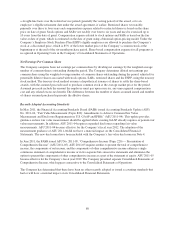

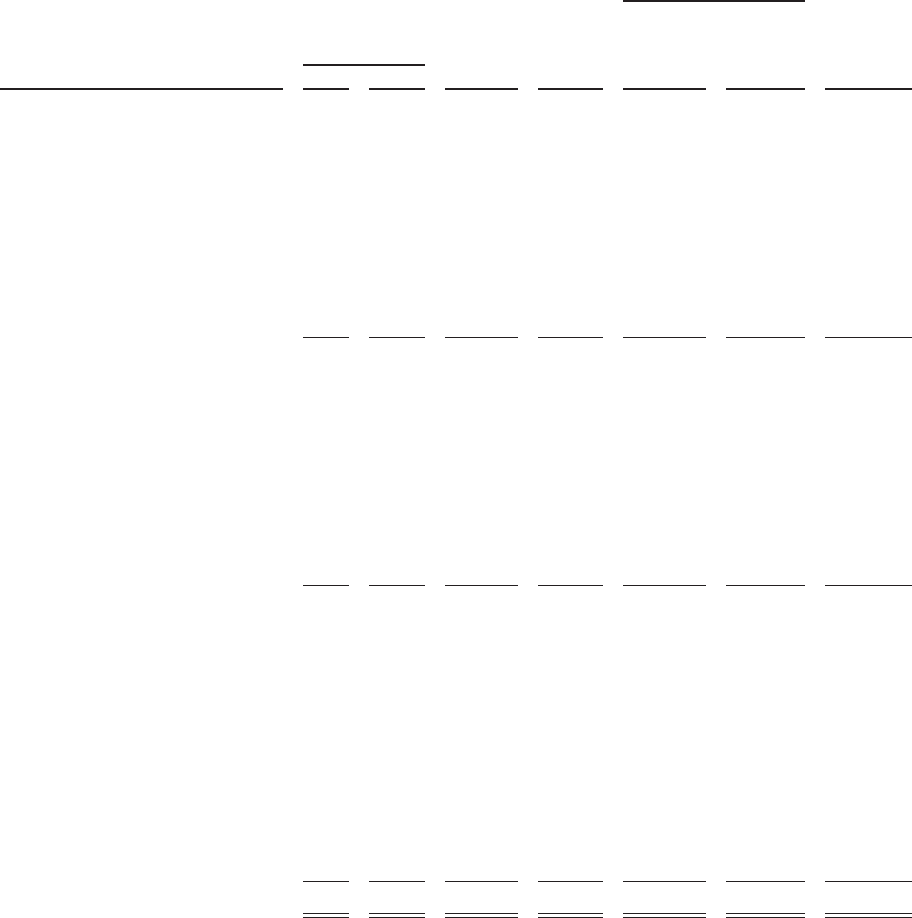

UnitedHealth Group

Consolidated Statements of Changes in Shareholders’ Equity

Common Stock

Accumulated Other

Comprehensive Income

(Loss)

Additional

Paid-In Retained

Net

Unrealized

Gains on

Foreign

Currency

Translation

(Losses)

(in millions) Shares Amount Capital Earnings Investments Gains Total Equity

Balance at January 1, 2010 ..... 1,147 $11 $ — $23,342 $277 $(24) $23,606

Net earnings .................. 4,634 4,634

Other comprehensive income .... 3 (4) (1)

Issuances of common stock, and

related tax effects ............ 15 — 207 207

Share-based compensation, and

related tax benefits ........... 345 345

Common stock repurchases ...... (76) — (552) (1,965) (2,517)

Cash dividends paid on common

stock ...................... (449) (449)

Balance at December 31, 2010 . . 1,086 11 — 25,562 280 (28) 25,825

Net earnings .................. 5,142 5,142

Other comprehensive income .... 196 13 209

Issuances of common stock, and

related tax effects ............ 18 — 308 308

Share-based compensation, and

related tax benefits ........... 453 453

Common stock repurchases ...... (65) (1) (761) (2,232) (2,994)

Cash dividends paid on common

stock ...................... (651) (651)

Balance at December 31, 2011 . . 1,039 10 — 27,821 476 (15) 28,292

Net earnings .................. 5,526 5,526

Other comprehensive income .... 40 (63) (23)

Issuances of common stock, and

related tax effects ............ 37 — 704 704

Share-based compensation, and

related tax benefits ........... 594 594

Common stock repurchases ...... (57) — (1,221) (1,863) (3,084)

Acquisition of noncontrolling

interest .................... (11) (11)

Cash dividends paid on common

stock ...................... (820) (820)

Balance at December 31, 2012 . . 1,019 $10 $ 66 $30,664 $516 $(78) $31,178

See Notes to the Consolidated Financial Statements

70