United Healthcare 2012 Annual Report Download - page 80

Download and view the complete annual report

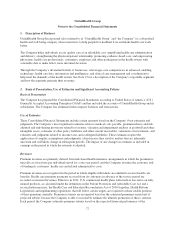

Please find page 80 of the 2012 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.To determine whether goodwill is impaired, the Company performs a multi-step impairment test. First, the

Company can elect to perform a qualitative assessment of each reporting unit to determine whether facts and

circumstances support a determination that their fair values are greater than their carrying values. If the

qualitative analysis is not conclusive, or if the Company elects to proceed directly with quantitative testing, it

will then measure the fair values of the reporting units and compare them to their aggregate carrying values,

including goodwill. If the fair value is less than the carrying value of the reporting unit, then the implied value of

goodwill would be calculated and compared to the carrying amount of goodwill to determine whether goodwill is

impaired.

The Company estimates the fair values of its reporting units using discounted cash flows. To determine fair

values, the Company must make assumptions about a wide variety of internal and external factors. Significant

assumptions used in the impairment analysis include financial projections of free cash flow (including significant

assumptions about operations, capital requirements and income taxes), long-term growth rates for determining

terminal value, and discount rates. Comparative market multiples are used to corroborate the results of the

discounted cash flow test.

The Company elected to bypass the optional qualitative reporting-unit fair value assessment and completed its

annual quantitative test for goodwill impairment as of January 1, 2013. As of December 31, 2012, no reporting

unit had a fair value less than its carrying value and the Company concluded that there was no need for any

impairment of its goodwill balances.

Intangible assets

Separately-identifiable intangible assets are acquired in business combinations and are assets that represent future

expected benefits but lack physical substance (e.g., membership lists, customer contracts, trademarks and

technology). The Company’s intangible assets are initially recorded at their fair values. Finite-lived intangible

assets are amortized over their expected useful lives.

The Company’s intangible assets are subject to impairment tests when events or circumstances indicate that an

intangible asset’s (or asset group’s) may be impaired. The Company’s indefinite lived intangible assets are also

tested for impairment annually. There were no material impairments of intangible assets during the year ended

December 31, 2012.

Other Policy Liabilities

Other policy liabilities include the RSF associated with the AARP Program (described below), health savings

account deposits, deposits under the Medicare Part D program (see “Medicare Part D Pharmacy Benefits”

above), accruals for premium rebate payments under the Health Reform Legislation, the current portion of future

policy benefits and customer balances. Customer balances represent excess customer payments and deposit

accounts under experience-rated contracts. At the customer’s option, these balances may be refunded or used to

pay future premiums or claims under eligible contracts.

Underwriting gains or losses related to the AARP Program are directly recorded as an increase or decrease to

the RSF and accrue to the overall benefit of the AARP policyholders, unless cumulative net losses were to

exceed the balance in the RSF. The primary components of the underwriting results are premium revenue,

medical costs, investment income, administrative expenses, member service expenses, marketing expenses and

premium taxes. To the extent underwriting losses exceed the balance in the RSF, losses would be borne by the

Company. Deficits may be recovered by underwriting gains in future periods of the contract. To date, the

Company has not been required to fund any underwriting deficits. Changes in the RSF are reported in Medical

Costs in the Consolidated Statement of Operations. As of December 31, 2012 and 2011, the balance in the RSF

was $1.3 billion.

78