Under Armour 2014 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2014 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

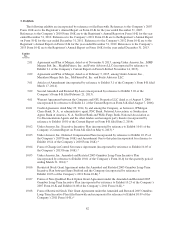

A

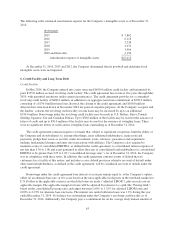

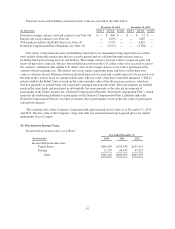

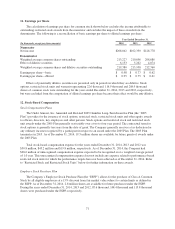

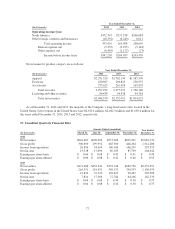

summary of the Company’s stock options as of December 31, 2014, 2013 and 2012, and changes durin

g

the years then ended is presented below

:

(

In thousands, except per share amounts

)

Year Ended December

31,

2014

2013

2012

N

umber

o

f

S

tock

O

pt

i

on

s

W

e

i

ghted

Avera

g

e

Ex

e

r

c

i

se

Pr

i

c

e

N

umber

o

f

S

tock

O

pt

i

ons

W

e

i

ghted

Avera

g

e

Ex

e

r

c

i

se

Pr

i

c

e

N

umber

o

f

S

toc

k

O

pt

i

ons

W

e

i

ghted

Avera

g

e

Ex

e

r

c

i

se

Pr

i

c

e

O

utstandin

g

,be

g

innin

g

of year 4,272 $ 8.11 6,298 $ 7.66 9,616 $7.0

0

G

ranted, at fair market value — — 20 24.35 — —

E

xercised (1,454) 7.74 (1,822) 6.68 (2,436) 5.09

E

x

p

ired — — — — — —

F

orfeited (7) 1

6

.4

6

(224) 8.41 (882) 7.

60

O

utstand

i

ng, end o

f

yea

r

2

,

811

$

8.28 4

,

272

$

8.11 6

,

298

$

7.66

Op

t

i

ons exerc

i

sable, end o

fy

ea

r

2

,

707

$

7.87 2

,

346

$

7.80 1

,

936

$

6.55

The intrinsic value of stock options exercised durin

g

the

y

ears ended December 31, 2014, 2013 and 2012

was $73.0 million, $44.1 million and $44.5 million, respectivel

y.

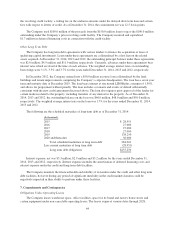

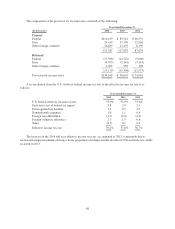

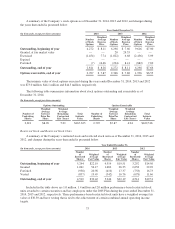

T

h

e

f

o

ll

ow

i

n

g

ta

bl

e summar

i

zes

i

n

f

ormat

i

on a

b

out stoc

k

opt

i

ons outstan

di

n

g

an

d

exerc

i

sa

bl

easo

f

Decem

b

er 31

,

2014:

(

In t

h

ousan

d

s, exce

p

t

p

er s

h

are amounts

)

Options Outstandin

g

Options Exercisable

N

umber o

f

Underlyin

g

S

hares

Wei

g

hted

A

verag

e

Exerc

i

s

e

P

ri

ce

P

er

S

har

e

W

ei

g

hted

A

verage

Rema

i

n

i

ng

C

ontractual

Life

(

Years

)

T

ota

l

Intrin

s

i

c

V

a

l

ue

N

umber o

f

Underlyin

g

S

hares

W

ei

g

hted

A

verage

Exerc

i

s

e

P

ri

ce

P

er

S

hare

W

ei

g

hted

A

verage

Rema

i

n

i

ng

C

ontractual

Life

(

Years

)

T

ota

l

Intrin

s

i

c

V

a

l

ue

2

,811

$

8.28 5.01

$

167,623 2,707

$

7.87 4.94

$

162,51

8

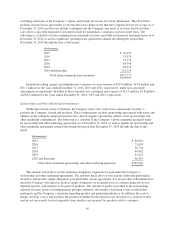

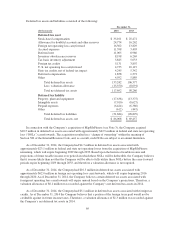

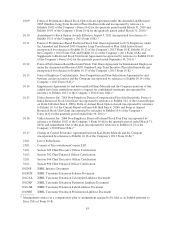

R

estricte

dS

toc

k

an

d

Restricte

dS

toc

kU

nits

A

summar

y

o

f

t

h

e Compan

y

’s restr

i

cte

d

stoc

k

an

d

restr

i

cte

d

stoc

k

un

i

ts as o

f

Decem

b

er 31, 2014, 2013 an

d

2012, an

d

c

h

an

g

es

d

ur

i

n

g

t

h

e

y

ears t

h

en en

d

e

di

s presente

db

e

l

ow:

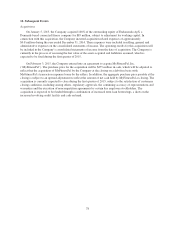

Year Ended December 31,

(

In t

h

ousan

d

s, exce

p

t

p

er s

h

are amounts

)

2

0

1

4

201

3

20

12

N

um

b

er

o

f

Res

tri

c

t

ed

S

hare

s

We

i

ghted

Avera

ge

Fair Valu

e

N

um

b

er

of

Res

tri

c

t

ed

S

hare

s

W

e

i

ghted

Avera

g

e

Fair Valu

e

N

um

b

e

r

o

f

R

es

tri

c

t

ed

S

hares

We

i

ghte

d

A

vera

ge

F

air Value

O

utstand

i

ng, beg

i

nn

i

ng o

f

year

5

,244

$

22.19 4,514

$

19.51 3,292

$

14.5

6

G

ranted 1,061

5

4.17 1,682 26.3

5

2,6

5

8 22.92

Forfeited (9

5

8) 20.98 (410) 17.37 (7

5

8) 16.73

Vested (837) 19.49 (

5

42) 16.76 (678) 11.6

6

O

utstanding, end of yea

r

4

,

510 $30.42 5

,

244 $22.19 4

,

514 $19.51

I

ncluded in the table above are 1.0 million, 1.4 million and 2.0 million

p

erformance-based restricted stock

units awarded to certain executives and key employees under the 200

5

Plan during the years ended December 31

,

2014, 2013 and 2012, respectively. These performance-based restricted stock units have a weighted average fair

value of

$

30.30 and have vesting that is tied to the achievement of certain combined annual operating income

t

arge

t

s.

7

3