Under Armour 2014 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2014 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A

s of December 31, 2014, approximately

$

129.2 million of cash and cash equivalents was held by the

Company’s non-U.S. subsidiaries whose cumulative undistributed earnings total

$

176.8 million. Withholding and

U

.S. taxes have not been provided on the undistributed earnings as the earnings are being permanently reinvested

in its non-U.S. subsidiaries. Determining the tax liability that would arise if these earnings were repatriated is not

p

ractical.

We utilize the “with and without” method for intra

p

eriod allocation of income tax

p

rovisions. Certain tax

benefits associated with the Company’s stock-based compensation arrangements are recorded directly t

o

Stockholders’ equity including benefit from excess tax deductions

.

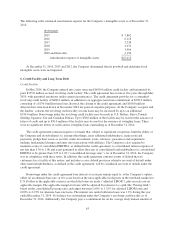

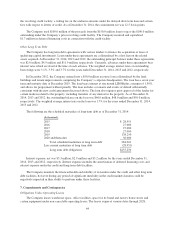

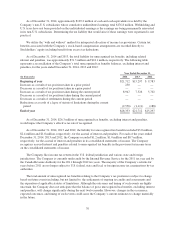

A

s of December 31, 2014 and 2013, the total liability for unrecognized tax benefits, including related

interest and penalties, was approximately

$

31.3 million and

$

24.1 million, respectively. The following table

r

epresents a reconciliation of the Company’s total unrecognized tax benefits balances, excluding interest an

d

p

enalties, for the years ended December 31, 2014, 2013 and 2012:

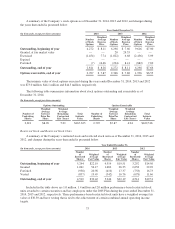

Year Ended December 31,

(

In t

h

ousan

d

s

)

20

1

4

2013 2

0

1

2

Beg

i

nn

i

ng o

f

yea

r

$

21,712

$

15,297

$

9,783

Increases as a result of tax

p

ositions taken in a

p

rior

p

eriod 2

5

0— —

Decreases as a result of tax

p

ositions taken in a

p

rior

p

eriod — — —

Increases as a result of tax positions taken during the current period 8,947 7,

5

26

5

,702

Decreases as a result of tax positions taken during the current period — — —

Decreases as a result of settlements during the current period — — —

R

eductions as a result of a lapse of statute of limitations during the curren

t

p

eriod (2,

55

6) (1,111) (188

)

End o

f

year

$

28

,

353

$

21

,

712

$

15

,

29

7

A

s of December 31, 2014,

$

26.3 million of unrecognized tax benefits, excluding interest and penalties,

wou

ld i

mpact t

h

e Company’s e

ff

ect

i

ve tax rate

if

recogn

i

ze

d

.

A

s of December 31, 2014, 2013 and 2012, the liability for unrecognized tax benefits included

$

3.0 million

,

$

2.4 million and

$

1.8 million, respectively, for the accrual of interest and penalties. For each of the years ended

December 31, 2014, 2013 and 2012, the Company recorded

$

1.2 million,

$

1.0 million and

$

0.7 million,

r

espect

i

ve

l

y,

f

or t

h

e accrua

l

o

fi

nterest an

d

pena

l

t

i

es

i

n

i

ts conso

lid

ate

d

statements o

fi

ncome. T

h

e Company

r

ecogn

i

zes accrue

di

nterest an

d

pena

l

t

i

es re

l

ate

d

to unrecogn

i

ze

d

tax

b

ene

fi

ts

i

nt

h

e prov

i

s

i

on

f

or

i

ncome taxes

o

nt

h

e conso

lid

ate

d

statements o

fi

ncome

.

T

h

e Company

fil

es

i

ncome tax returns

i

nt

h

e U.S.

f

e

d

era

lj

ur

i

s

di

ct

i

on an

d

var

i

ous state an

df

ore

i

g

n

j

ur

i

s

di

ct

i

ons. T

h

e Company

i

s current

l

yun

d

er au

di

t

b

yt

h

e Interna

l

Revenue Serv

i

ce

f

or t

h

e 2011 tax year an

db

y

t

h

e Cana

d

a Revenue Aut

h

or

i

ty

f

or t

h

e 2011 t

h

roug

h

2012 tax years. T

h

ema

j

or

i

ty o

f

t

h

e Company’s returns

f

o

r

y

ears

b

e

f

ore 2011 are no

l

onger su

bj

ect to U.S.

f

e

d

era

l

, state an

dl

oca

l

or

f

ore

i

gn

i

ncome tax exam

i

nat

i

ons

b

y tax

aut

h

or

i

t

i

es

T

h

e tota

l

amount o

f

unrecogn

i

ze

d

tax

b

ene

fi

ts re

l

at

i

ng to t

h

e Company’s tax pos

i

t

i

ons

i

ssu

bj

ect to c

h

ange

b

ase

d

on

f

uture events

i

nc

l

u

di

ng,

b

ut not

li

m

i

te

d

to, t

h

e sett

l

ements o

f

ongo

i

ng tax au

di

ts an

d

assessments an

d

t

h

e exp

i

rat

i

on o

f

app

li

ca

bl

e statutes o

fli

m

i

tat

i

ons. A

l

t

h

oug

h

t

h

e outcomes an

d

t

i

m

i

ng o

f

suc

h

events are

hi

g

hly

uncerta

i

n, t

h

e Compan

yd

oes not ant

i

c

i

pate t

h

at t

h

e

b

a

l

ance o

fg

ross unreco

g

n

i

ze

d

tax

b

ene

fi

ts, exc

l

u

di

n

gi

nteres

t

an

d

pena

l

t

i

es, w

ill

c

h

an

g

es

ig

n

ifi

cant

ly d

ur

i

n

g

t

h

e next twe

l

ve mont

h

s. However, c

h

an

g

es

i

nt

h

e occurrence,

expecte

d

outcomes, an

d

t

i

m

i

n

g

o

f

suc

h

events cou

ld

cause t

h

e Compan

y

’s current est

i

mates to c

h

an

g

e mater

i

a

lly

i

nt

h

e

f

uture

.

7

0