Under Armour 2014 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2014 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

P

A

RT I

I

I

TEM 5. MARKET FOR REGI

S

TRANT’

S

COMMON EQUITY

,

RELATED

S

TOCKHOLDER

MATTER

S

AND I

SS

UER PURCHA

S

E

S

OF EQUITY

S

ECURITIE

S

Un

d

er Armour’s C

l

ass A Common Stoc

ki

s tra

d

e

d

on t

h

e New Yor

k

Stoc

k

Exc

h

an

g

e (“NYSE”) un

d

er t

he

s

y

mbol “UA”. As of Januar

y

31, 2015, there were 1,151 record holders of our Class A Common Stock and

5

record holders of Class B Convertible Common Stock which are beneficiall

y

owned b

y

our Chief Executive

O

ffi

cer an

d

C

h

a

i

rman o

f

t

h

e Boar

d

Kev

i

nA.P

l

an

k

.T

h

e

f

o

ll

ow

i

n

g

ta

bl

e sets

f

ort

hby

quarter t

h

e

high

an

dl

ow

sa

l

epr

i

ces o

f

our C

l

ass A Common Stoc

k

on t

h

e NYSE

d

ur

i

n

g

2014 an

d

2013

.

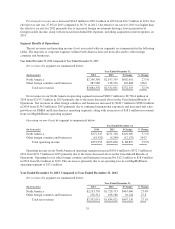

H

i

gh

L

ow

2014

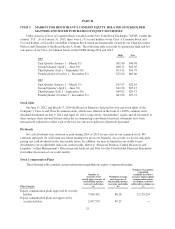

First Quarter (January 1 – March 31)

$

62.40

$

40.98

Second Quarter (A

p

ril 1 – June 30)

$

60.17

$

45.0

5

T

hird Quarter (July 1 – September 30)

$

73.42

$

56.79

Fourth

Q

uarter (October 1 – December 31)

$

72.98

$

60.0

0

2013

First Quarter (January 1 – March 31)

$

25.97

$

22.1

6

Second Quarter (A

p

ril 1 – June 30)

$

32.78

$

25.1

5

T

hird Quarter (July 1 – September 30)

$

40.82

$

29.7

3

Fourth

Q

uarter (October 1 – December 31)

$

43.96

$

37.72

S

tock S

p

lit

On June 11, 2012 and March 17, 2014 the Board of Directors declared two-for-one stock s

p

lits of the

Company’s Class A and Class B common stock, which were effected in the form of a 100% common stoc

k

dividend distributed on July 9, 2012 and April 14, 2014, respectively. Stockholders’ equity and all references to

share and per share amounts herein and in the accompanying consolidated financial statements have bee

n

r

etroactively adjusted to reflect each of the two-for-one stock splits for all periods presented

.

D

i

v

i

de

n

ds

N

o cash dividends were declared or paid during 2014 or 2013 on any class of our common stock. We

currently anticipate we will retain any future earnings for use in our business. As a result, we do not anticipate

p

aying any cash dividends in the foreseeable future. In addition, we may be limited in our ability to pa

y

dividends to our stockholders under our credit facility. Refer to “Financial Position, Capital Resources and

Liquidity” within Management’s Discussion and Analysis and Note 6 to the Consolidated Financial Statement

s

f

or further discussion of our credit facility.

S

tock Com

p

ensation Plans

The following table contains certain information regarding our equity compensation plans

.

P

lan Categor

y

N

umber o

f

secu

riti

es

t

obe

i

ssued u

p

on exercise o

f

o

utstand

i

ng opt

i

ons

,

warrants and ri

g

ht

s

(

a

)

Wei

g

hted-avera

ge

exercise

p

rice o

f

o

utstand

i

ng opt

i

ons

,

warrants and ri

g

hts

(

b

)

N

umber of securities

r

ema

i

n

i

ng

ava

i

lable

f

or

f

utur

e

issuance under equity

com

p

ensation

p

lan

s

(

excluding securitie

s

reflected in column (a)

)

(

c

)

Equity compensation plans approved by security

holders 7,840,362

$

8.28 22,118,204

Equity compensation plans not approved b

y

security holders 2,017,578

$

9.25

—

2

5