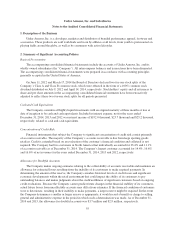

Under Armour 2014 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2014 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

f

orward foreign currency exchange rates of 1.13 CAD per

$

1.00

,

€

0.83

p

er

$

1.00, 145.16 JPY

p

er

€

1.00, 17.8

5

MXN

p

e

r

€

1

.00 and £0.78

p

er

€

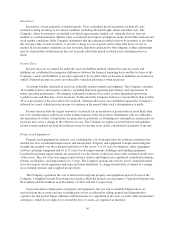

1.00. The majority of our foreign currency forward contracts are not designate

d

as cash flow hedges, and accordingly, changes in their fair value are recorded in earnings. During 2014, w

e

began entering into foreign currency forward contracts designated as cash flow hedges. For foreign currenc

y

f

orward contracts designated as cash flow hedges, changes in fair value, excluding any ineffective portion, is

r

ecorded in other comprehensive income until net income is affected by the variability in cash flows of the

hedged transaction. The effective portion is generally released to net income after the maturity of the relate

d

derivative and is classified in the same manner as the underlying exposure. During the year ended December 31

,

2014, we reclassified

$

0.4 million from other comprehensive income to cost of goods sold related to foreign

currency forward contracts designated as cash flow hedges. The fair values of the Company’s foreign currenc

y

f

orward contracts were assets of

$

806.0 thousand and

$

12.1 thousand as of December 31, 2014 and 2013

,

r

espectively, and were included in prepaid expenses and other current assets on the consolidated balance sheet

.

R

efer to Note

9

to the Consolidated Financial Statements for a discussion of the fair value measurements.

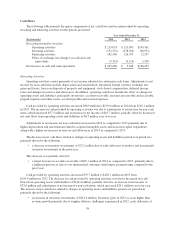

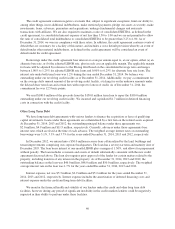

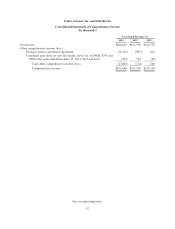

Included in other expense, net were the following amounts related to changes in foreign currency exchange rates

and derivative foreign currency forward contracts

:

(

In t

h

ousan

d

s

)

Year Ended December 31,

2

0

14 2013 2

0

12

U

nrealized foreign currency exchange rate gains (losses)

$

(11,739)

$

(1,905)

$

2,46

4

R

ealized foreign currency exchange rate gains (losses) 2,247 477 (182

)

U

nrealized derivative gains (losses) 1 13 67

5

R

ealized derivative gains (losses) 3,081 243 (3,030

)

We enter into foreign currency forward contracts with major financial institutions with investment grade

credit ratings and are exposed to credit losses in the event of non-performance by these financial institutions.

T

his credit risk is generally limited to the unrealized gains in the foreign currency forward contracts. However

,

we monitor the credit quality of these financial institutions and consider the risk of counterparty default to b

e

minimal. Although we have entered into foreign currency forward contracts to minimize some of the impact o

f

f

oreign currency exchange rate fluctuations on future cash flows, we cannot be assured that foreign currency

exchange rate fluctuations will not have a material adverse impact on our financial condition and results o

f

op

erations.

Intere

s

t Rate Ri

s

k

I

n order to maintain liquidity and fund business operations, we enter into long term debt arrangements with

various lenders which bear a range of fixed and variable rates of interest. The nature and amount of our long-term

debt can be expected to vary as a result of future business requirements, market conditions and other factors. W

e

may elect to enter into interest rate swap contracts to reduce the impact associated with interest rate fluctuations

.

W

e utilize interest rate swa

p

contracts to convert a

p

ortion of variable rate debt to fixed rate debt. The contracts

p

ay fixed and receive variable rates of interest. The interest rate swap contracts are accounted for as cash flo

w

hedges and accordingly, the effective portion of the changes in fair value are recorded in other comprehensive

income and reclassified into interest expense over the life of the underlying debt obligation

.

A

s of December 31, 2014, the aggregate notional value of our outstanding interest rate swap contracts wa

s

$

188.1 million. During the years ended December 31, 2014 and 2013, we recorded a

$

1.7 million an

d

$

0.3 million increase in interest expense, respectively, representing the effective portion of the contracts

r

eclassified from accumulated other com

p

rehensive income. The fair value of the interest rate swa

p

contracts wa

s

a liability of

$

0.6 million as of December 31, 2014, and was included in other long term liabilities on th

e

consolidated balance sheet. The fair value of the interest rate swa

p

contract was an asset of

$

1.1 million as o

f

December 31, 2013 and was included in other long term assets on the consolidated balance sheet

.

4

6