Under Armour 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

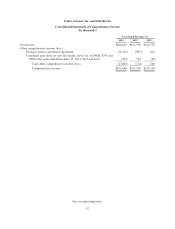

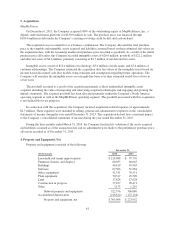

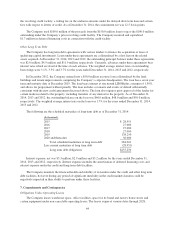

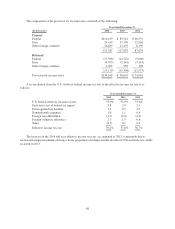

Construction in progress primarily includes costs incurred for software systems, leasehold improvement

s

and in-store fixtures and displays not yet placed in use

.

Depreciation expense related to property and equipment was

$

63.6 million,

$

48.3 million and

$

39.8 millio

n

f

or the years ended December 31, 2014, 2013 and 2012, respectively

.

5.

G

oodw

i

ll and Intang

i

ble Assets, Ne

t

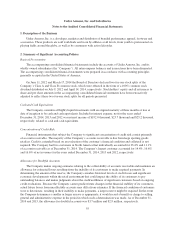

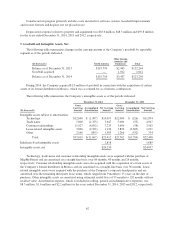

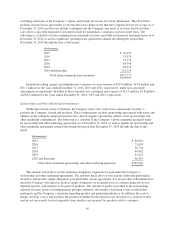

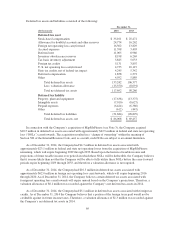

The following table summarizes changes in the carrying amount of the Company’s goodwill by reportable

segment as of the periods indicated

:

(

In t

h

ousan

d

s

)

North Americ

a

O

ther

f

ore

i

gn

countr

i

es an

d

bus

in

esses

T

o

t

a

l

B

alance as of December 31

,

2013

$

119

,

799

$

2

,

445

$

122

,

244

G

oo

d

w

ill

acqu

i

re

d

— 1,012 1,012

B

alance as of December 31, 2014 $119,799 $3,457 $123,25

6

Durin

g

2014, the Compan

y

acquired $1.0 million of

g

oodwill in connection with the acquisition of certain

assets o

fi

ts

f

ormer

di

str

ib

utor

i

n Mex

i

co, w

hi

c

h

was accounte

df

or as a

b

us

i

ness com

bi

nat

i

on

.

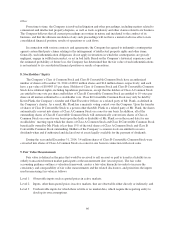

T

h

e

f

o

ll

ow

i

n

g

ta

bl

e summar

i

zes t

h

e Compan

y

’s

i

ntan

gibl

e assets as o

f

t

h

e per

i

o

d

s

i

n

di

cate

d:

D

ecember

31, 2014

December

31, 2013

(

In t

h

ousan

d

s

)

G

ross

Carryin

g

A

mount

A

ccu

m

u

l

a

t

ed

A

mort

i

zat

i

o

n

N

et Carryin

g

A

moun

t

G

ros

s

C

arryin

g

A

mount

A

ccu

m

u

l

a

t

ed

Amort

i

zat

i

on

Net Carryin

g

A

moun

t

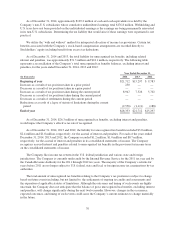

Intangible assets subject to amortization

:

Technology

$

12,000

$

(1,907)

$

10,093

$

12,000

$

(126)

$

11,87

4

Trade name

5

,000 (1,3

5

3) 3,647

5

,000 (

5

3) 4,94

7

Customer relationshi

p

s 11,927 (4,692) 7,23

5

3,600 (38) 3,

5

62

L

ease-related intangible assets 3,896 (2,762) 1,134 3,896 (2,60

5

) 1,291

Other 2,196 (893) 1,303 1,266 (

5

32) 734

T

otal

$

35,019

$(

11,607

)$

23,412

$

25,762

$(

3,354

)$

22,40

8

Indefinite-lived intangible assets 2,818 1,68

9

Intan

g

ible assets, net $26,230 $24,097

Tec

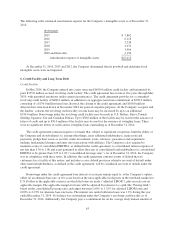

h

no

l

o

gy

, tra

d

e-name an

d

customer re

l

at

i

ons

hi

p

i

ntan

gibl

e assets were acqu

i

re

d

w

i

t

h

t

h

e purc

h

ase o

f

MapM

y

F

i

tness an

d

are amort

i

ze

d

on a stra

igh

t-

li

ne

b

as

i

s over 84 mont

h

s, 48 mont

h

san

d

24 mont

h

s,

r

espectivel

y

. Customer relationship intan

g

ible assets were also acquired with the acquisition of certain assets of

the Compan

y

’s former distributor in Mexico and are amortized on a strai

g

ht-line basis over 3

6

months. Lease-

r

elated intan

g

ible assets were acquired with the purchase of the Compan

y

’s corporate headquarters and are

amortized over the remainin

g

third part

y

lease terms, which ran

g

ed from 9 months to 15

y

ears on the date of

p

urchase. Other intan

g

ible assets are amortized usin

g

estimated useful lives of 55 months to 120 months with n

o

r

esidual value. Amortization expense, which is included in sellin

g

,

g

eneral and administrative expenses, wa

s

$

8.5 million, $1.6 million and $2.2 million for the

y

ears ended December 31, 2014, 2013 and 2012, respectivel

y

.

62