Under Armour 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

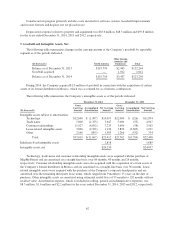

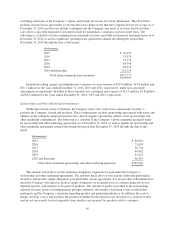

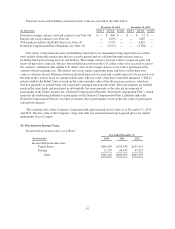

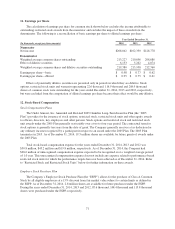

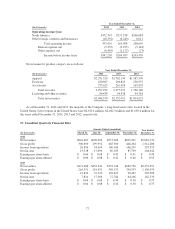

Deferred tax assets and liabilities consisted of the following

:

December 31,

(

In t

h

ousan

d

s

)

20

1

4

2

01

3

D

e

f

erred tax asset

Stock-based com

p

ensation

$

35,161

$

25,47

2

Allowance for doubtful accounts and other reserves 24,774 1

6

,2

6

2

Foreign net operating loss carryforward 1

6

,302 13,829

Accrued ex

p

enses 11,398 3,40

3

Deferred rent 11,00

5

8,980

Inventory obsolescence reserves 8,198

6

,2

6

9

T

ax basis inventory adjustment

5

,84

55

,633

Foreign tax credits

5

,131 3,807

U

. S. net operating loss carryforward 4,733 10,119

State tax credits, net of federal tax im

p

act 4,24

55

,342

Deferred com

p

ensation 1,8

5

8 1,372

Other 4,

5

92

5

,88

9

Total deferred tax assets 133

,

242 106

,

377

L

ess: valuation allowance

(

1

5

,

55

0

)(

8,091

)

Total net deferred tax assets 117,

6

92 98,28

6

D

e

f

erred tax l

i

ab

i

l

i

t

y

Property, plant and equipment (17,638) (13,37

5

)

Intangible assets (7,010) (8,

6

27)

Pre

p

aid ex

p

enses (

6

,424) (

6

,380

)

Other (

6

12) (447

)

Total deferred tax liabilities

(

31,684

)(

28,829

)

Total deferred tax assets, net $ 86,008 $ 69,457

I

n connect

i

on w

i

t

h

t

h

e Compan

y

’s acqu

i

s

i

t

i

on o

f

MapM

y

F

i

tness (see Note 3), t

h

e Compan

y

acqu

i

re

d

$

10.5 million in deferred tax assets associated with approximatel

y

$42.5 million in federal and state net operatin

g

l

oss (“NOLs”) carr

yf

orwar

d

s. T

h

e acqu

i

s

i

t

i

on resu

l

te

di

na“c

h

an

g

eo

f

owners

hi

p” w

i

t

hi

nt

h

e mean

i

n

g

o

f

Sect

i

on 382 o

f

t

h

e Interna

l

Revenue Co

d

e, an

d

, as a resu

l

t, suc

h

NOLs are su

bj

ect to an annua

lli

m

i

tat

i

on

.

A

s of December 31, 2014, the Compan

y

had $4.7 million in deferred tax assets associated wit

h

approximatel

y

$23.1 million in federal and state net operatin

g

losses from the acquisition of MapM

y

Fitnes

s

r

ema

i

n

i

n

g

,w

hi

c

h

w

ill

exp

i

re

b

e

gi

nn

i

n

g

2029 t

h

rou

gh

2033. Base

d

upon t

h

e

hi

stor

i

ca

l

taxa

bl

e

i

ncome an

d

p

ro

j

ect

i

ons o

ff

uture taxa

bl

e

i

ncome over per

i

o

d

s

i

nw

hi

c

h

t

h

ese NOLs w

ill b

e

d

e

d

uct

ibl

e, t

h

e Compan

yb

e

li

eves

that it is more likel

y

than not that the Compan

y

will be able to full

y

utilize these NOLs before the carr

y

-forwar

d

p

eriods expire be

g

innin

g

2029 throu

g

h 2033, and therefore a valuation allowance is not required.

A

s of December 31, 2014, the Compan

y

had $16.3 million in deferred tax assets associated wit

h

approximatel

y

$62.0 million in forei

g

n net operatin

g

loss carr

y

forwards, which will expire be

g

innin

g

2016

throu

g

h 2020. As of December 31, 2014, the Compan

y

believes certain deferred tax assets associated wit

h

f

orei

g

n net operatin

g

loss carr

y

forwards will expire unused based on the Compan

y

’s pro

j

ections. Therefore,

a

valuation allowance of $6.1 million was recorded a

g

ainst the Compan

y

’s net deferred tax assets in 2014.

A

s of December 31, 2014, the Compan

y

had $5.1 million in deferred tax assets associated with forei

g

nta

x

credits. As of December 31, 2014 the Compan

y

believes that a portion of the forei

g

n taxes paid would not be

creditable a

g

ainst its future income taxes. Therefore, a valuation allowance of $1.3 million was recorded a

g

ainst

the Compan

y

’s net deferred tax assets in 2014

.

69