Under Armour 2014 Annual Report Download - page 55

Download and view the complete annual report

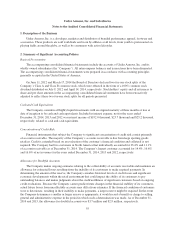

Please find page 55 of the 2014 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.amount that reflects the consideration which the entity expects to be entitled to in exchange for those goods o

r

services. This guidance is effective for annual and interim reporting periods beginning after December 1

5

, 2016

,

with early adoption not permitted. We are currently evaluating the standard to determine the impact of it

s

ado

p

tion on our consolidated financial statements

.

I

n January 201

5

, the FASB issued an Accounting Standards Update which eliminates from GAAP th

e

concept of extraordinary items and the need to separately classify, present, and disclose extraordinary events and

transactions. This guidance is effective for annual and interim reporting periods beginning after December 1

5,

201

5

, with early adoption permitted provided that the guidance is applied from the beginning of the fiscal year of

ado

p

tion. The ado

p

tion of this

p

ronouncement is not ex

p

ected to im

p

act our consolidated financial statements.

R

ecently Adopted Accounting

S

tandards

I

n July 2013, the FASB issued an Accounting Standards Update which requires that an unrecognized ta

x

benefit, or a portion of an unrecognized tax benefit, should be presented in the financial statements as a reduction

to a deferred tax asset for a net operating loss carryforward, a similar tax loss, or a tax credit carryforward, with

certain exceptions. This guidance is effective for annual and interim reporting periods beginning afte

r

December 1

5

, 2013. The ado

p

tion of this

p

ronouncement did not have a material im

p

act on our consolidated

f

inancial statements

.

I

n February 2013, the FASB issued an Accounting Standards Update which requires companies to present

either in a single note or parenthetically on the face of the financial statements, the effect of significant amounts

r

eclassified from each com

p

onent of accumulated other com

p

rehensive income based on its source and the

income statement line items affected by the reclassification. This guidance is effective for annual and interi

m

r

eporting periods beginning after December 1

5

, 2012. The adoption of this pronouncement did not have

a

material im

p

act on our consolidated financial statements.

I

TEM 7A. QUANTITATIVE AND QUALITATIVE DI

S

CLO

S

URE ABOUT MARKET RI

S

K

F

oreign Currency Risk

We current

ly g

enerate a ma

j

or

i

t

y

o

f

our conso

lid

ate

d

net revenues

i

nt

h

eUn

i

te

d

States, an

d

t

h

e report

i

n

g

currenc

yf

or our conso

lid

ate

dfi

nanc

i

a

l

statements

i

st

h

e U.S.

d

o

ll

ar. As our net revenues an

d

expenses

g

enerate

d

o

uts

id

eo

f

t

h

eUn

i

te

d

States

i

ncrease, our resu

l

ts o

f

operat

i

ons cou

ld b

ea

d

verse

ly i

mpacte

dby

c

h

an

g

es

i

n

f

ore

ign

currenc

y

exc

h

an

g

e rates. For examp

l

e, as we reco

g

n

i

ze

f

ore

ig

n revenues

i

n

l

oca

lf

ore

ig

n currenc

i

es an

dif

t

h

e

U

.S.

d

o

ll

ar stren

g

t

h

ens,

i

t cou

ld h

ave a ne

g

at

i

ve

i

mpact on our

f

ore

ig

n revenues upon trans

l

at

i

on o

f

t

h

ose resu

l

ts

i

nto t

h

e U.S.

d

o

ll

ar upon conso

lid

at

i

on o

f

our

fi

nanc

i

a

l

statements. In a

ddi

t

i

on, we are expose

d

to

g

a

i

ns an

d

l

osses resu

l

t

i

n

gf

rom

fl

uctuat

i

ons

i

n

f

ore

ig

n currenc

y

exc

h

an

g

e rates on transact

i

ons

g

enerate

dby

our

f

ore

ign

su

b

s

idi

ar

i

es

i

n currenc

i

es ot

h

er t

h

an t

h

e

i

r

l

oca

l

currenc

i

es. T

h

ese

g

a

i

ns an

dl

osses are pr

i

mar

ily d

r

i

ven

by

intercompan

y

transactions and inventor

y

purchases denominated in currencies other than the functional currenc

y

o

f the purchasin

g

entit

y

. These exposures are included in other expense, net on the consolidated statements of

income

.

F

rom time to time, we ma

y

elect to use forei

g

n currenc

y

forward contracts to reduce the risk from exchan

g

e

r

ate fluctuations primaril

y

on intercompan

y

transactions and pro

j

ected inventor

y

purchases for our internationa

l

subsidiaries. As we expand our international business, we anticipate expandin

g

our current hed

g

in

g

pro

g

ram to

include additional currenc

y

pairs and instruments. We do not enter into derivative financial instruments fo

r

speculative or tradin

g

purposes

.

A

s of December 31, 2014, the a

gg

re

g

ate notional value of our outstandin

g

forei

g

n currenc

y

forward

contracts was $123.3 million, which was comprised of Canadian Dollar/U.S. Dollar, Euro/U.S. Dollar, Yen/Euro

,

Mexican Peso/Euro and Pound Sterlin

g

/Euro currenc

y

pairs with contract maturities of one to eleven months

.

T

he forei

g

n currenc

y

forward contracts outstandin

g

as of December 31, 2014 have wei

g

hted avera

g

e contractual

4

5