Under Armour 2014 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2014 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

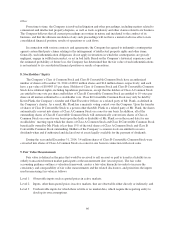

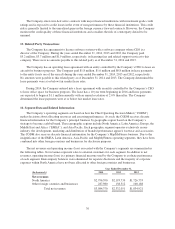

Non-Employee Director Compensation Plan and Deferred Stock Unit Plan

The Company’s Non-Employee Director Compensation Plan (the “Director Compensation Plan”) provide

s

f

or cash compensation and equity awards to non-employee directors of the Company under the 200

5

Plan. Non-

employee directors have the option to defer the value of their annual cash retainers as deferred stock units i

n

accordance with the Under Armour, Inc. Non-Employee Deferred Stock Unit Plan (the “DSU Plan”). Each ne

w

non-employee director receives an award of restricted stock units upon the initial election to the Board of

Directors, with the units covering stock valued at

$

100.0 thousand on the grant date and vesting in three equa

l

annual installments. In addition, each non-employee director receives, following each annual stockholders’

meeting, a grant under the 2005 Plan of restricted stock units covering stock valued at

$

75.0 thousand on the

grant date. Beginning in 2015, this annual grant is increasing from

$

75.0 thousand to

$

125.0 thousand. Each

award vests 100% on the date of the next annual stockholders’ meeting following the grant date.

The receipt of the shares otherwise deliverable upon vesting of the restricted stock units automatically

defers into deferred stock units under the DSU Plan. Under the DSU Plan each deferred stock unit re

p

resents the

Company’s obligation to issue one share of the Company’s Class A Common Stock with the shares delivered si

x

months following the termination of the director’s service.

S

tock O

p

tions

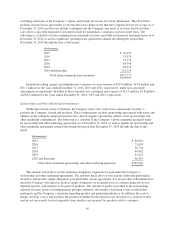

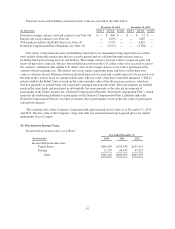

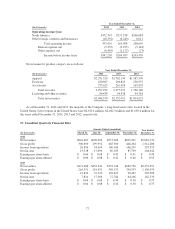

The weighted average fair value of a stock option granted for the year ended December 31, 2013 wa

s

$

12.91. The fair value of each stock option granted is estimated on the date of grant using the Black-Scholes

o

ption-pricing model with the following weighted average assumptions:

Y

ear

E

n

d

e

d

December

31,

2013

R

i

s

k

-

f

ree

i

nterest rate 1.2%

A

vera

g

e expected life in

y

ears 6.25

E

xpected volatilit

y

55.4

%

E

xpecte

ddi

v

id

en

dyi

e

ld

—%

T

h

ere were no stoc

k

opt

i

ons

g

rante

dd

ur

i

n

g

t

h

e

y

ears en

d

e

d

Decem

b

er 31, 2014 an

d

Decem

b

er 31, 2012

.

7

2