U-Haul 2004 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2004 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

general partner and has a direct 1% interest in Private Mini. AMERCO does not maintain operating control of

Private Mini and the minority holders have a substantial participation rights. During 1997, Private Mini

secured a line of credit $225.0 million with a Ñnancing institution, which was subsequently reduced in

accordance with its terms to $125.0 million in December 2001. Under the terms of this credit facility,

AMERCO entered into a support party agreement with Private Mini whereby upon default or noncompliance

with debt covenants by Private Mini, AMERCO assumes responsibility in fulÑlling all obligations related to

this credit facility.

At March 31, 2003 AMERCO had become contingently liable under the terms of the support agreement

for Private Mini. This guarantee is still in place at March 31, 2004. This resulted in increasing notes and loans

payable by $55.0 million and increasing our investment in a receivable from Private Mini by $55.0 million. As

of March 15, 2004 AMERCO paid $55.0 million as part of the bankruptcy settlement. Under the terms of

FIN 45, the Company recognized a liability in the amount of $70.0 million, which is management's estimate

on the liability associated with the guarantee. This resulted in increasing other liabilities by $70.0 million and

our receivable from Private Mini by $70.0 million.

The receivable from Private Mini Storage Realty, L.P. represents amounts due the company from Private

Mini Storage Realty, L.P. under a support agreement the Company entered to enhance the credit of Private

Mini Storage, L.P. The company expects to fully recover these amounts.

On June 30, 2003, RepWest and Oxford exchanged their respective interests in Private Mini for certain

real property owned by certain SAC Holding's entities. The exchanges were non-monetary and were recorded

on the basis of the book values of the assets exchanged. Private Mini has been determined not to be a variable

interest entity as deÑned by FIN 46R.

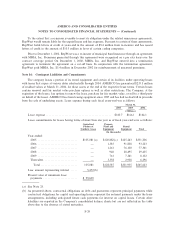

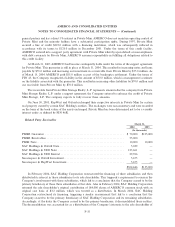

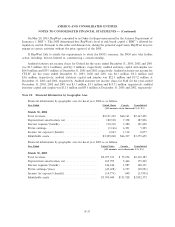

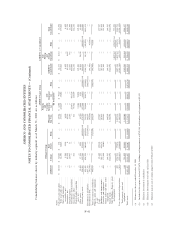

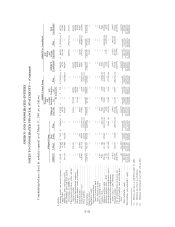

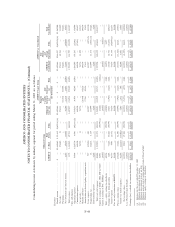

Related Party Receivables

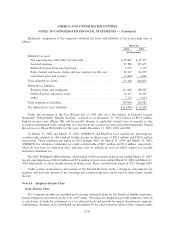

March 31,

2004 2003

(In thousands)

PMSR Guarantee ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 70,000 $125,000

PMSR Receivables ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 55,000

PMSI NoteÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 10,000 10,000

SAC Holdings & Oxford NoteÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 5,039 Ì

SAC Holdings & UHI Note ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 123,661 Ì

SAC Holdings & UHI Interest ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 29,396 Ì

Securespace & Oxford InvestmentÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 5,675 Ì

Securespace & RepWest InvestmentÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 5,675 Ì

$304,446 $135,000

In February 2004, SAC Holding Corporation restructured the Ñnancing of three subsidiaries and then

distributed its interest in those subsidiaries to its sole shareholder. This triggered a requirement to reassess the

Company's involvement with those subsidiaries, which led to a conclusion that the Company ceased to be the

primary beneÑciary of those three subsidiaries at that date. Also in February 2004, SAC Holding Corporation

returned the sole shareholder's original contribution of 184,000 shares of AMERCO common stock with an

original cost basis of $3.2 million, which was treated as a distribution. In March 2004, SAC Holding

Corporation restructured its Ñnancing, triggering a similar reassessment that led to a conclusion that the

Company ceased to be the primary beneÑciary of SAC Holding Corporation and its remaining subsidiaries.

Accordingly, at the dates the Company ceased to be the primary beneÑciary, it deconsolidated those entities.

The deconsolidation was accounted for as a distribution of the Company's interests to the sole shareholder of

F-35