U-Haul 2004 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2004 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

To the extent that a re-insurer is unable to meet its obligation under the related reinsurance agreements,

RepWest would remain liable for the unpaid losses and loss expenses. Pursuant to certain of these agreements,

RepWest holds letters of credit at years-end in the amount of $9.4 million from re-insurers and has issued

letters of credit in the amount of $10.3 million in favor of certain ceding companies.

Prior to December 1, 2002, RepWest was a re-insurer of municipal bond insurance through an agreement

with MBIA, Inc. Premiums generated through this agreement were recognized on a pro rata basis over the

contract coverage period. On December 1, 2002, MBIA, Inc. and RepWest entered into a termination

agreement to terminate the agreement on a cut-oÅ basis. In conjunction with the termination agreement,

RepWest paid MBIA, Inc. $3.4 million in December 2002 for reimbursement of unearned premiums.

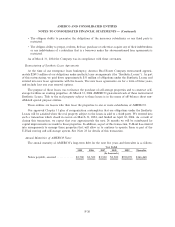

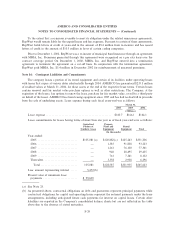

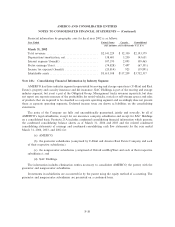

Note 16: Contingent Liabilities and Commitments

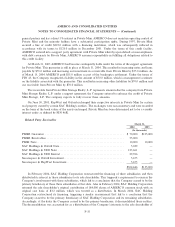

The company leases a portion of its rental equipment and certain of its facilities under operating leases

with terms that expire at various dates substantially through 2034. AMERCO has guaranteed $235.3 million

of residual values at March 31, 2004, for these assets at the end of the respective lease terms. Certain leases

contain renewal and fair market value purchase options as well as other restrictions. The Company, at the

expiration of the leases, has options to renew the lease, purchase for fair market value, or sell to a third party

on behalf of the lessor. AMERCO has been leasing equipment since 1987 and has had no shortfall in proceeds

from the sale of underlying assets. Lease expense during each Ñscal years-end was as follows:

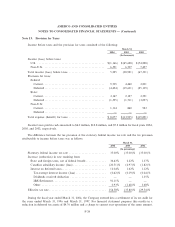

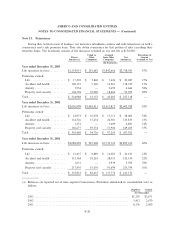

March 31,

2004 2003 2002

(Millions)

Lease expense ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $160.7 $166.1 $164.1

Lease commitments for leases having terms of more than one year as of Ñscal year-end were as follows:

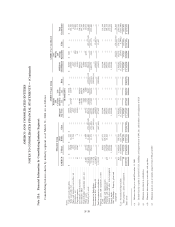

Capitalized Property

Portion of Plant and Rental

Synthetic Lease Equipment Equipment Total

(In thousands)

Year-ended:

2005 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $105,081(a) $120,882(c) $125,243 $351,206

2006 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì 1,385 91,838 93,223

2007 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì 1,261 76,100 77,361

2008 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì 940 28,495 29,435

2009 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì 761 7,341 8,102

ThereafterÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì 3,358 2,938 6,296

Total ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 105,081 $128,587 $331,955 $565,623

Less: amount representing interest ÏÏÏÏÏ 5,472(b)

Present value of minimum lease

payments ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 99,609

(a) See Note 23.

(b) As presented above, contractual obligations on debt and guarantees represent principal payments while

contractual obligations for capital and operating leases represent the notional payments under the lease

arrangements, including anticipated future cash payments for interest on capital leases. Certain other

liabilities are reported in the Company's consolidated balance sheets but are not reÖected in the table

above due to the absence of stated maturities.

F-29