U-Haul 2004 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2004 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

the delegation of authority from the Board of Directors, pursuant to the terms of the ProÑt Sharing Plan. No

contributions were made to the proÑt sharing plan during 2004, 2003 or 2002.

The Company also provides an employee saving plan which allows participants to defer income under

Section 401(k) of the Internal Revenue Code of 1986.

ESOP Plan

The Company also provides an Employee Stock Ownership Plan (the ""Plan'') under which the Company

may make contributions of its common stock or cash to acquire such stock on behalf of participants.

Generally, employees are eligible to participate in the Plan upon completion of one year of service. The

Company has arranged Ñnancing to fund the ESOP Trust (ESOT) and to enable the ESOT to purchase

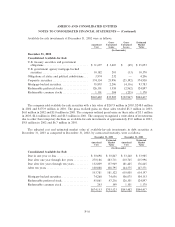

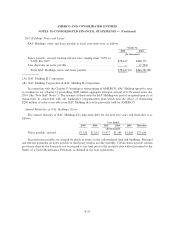

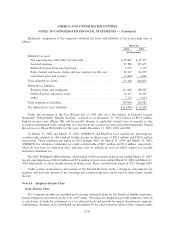

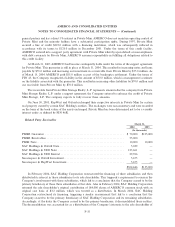

shares. Listed below is a summary of these Ñnancing arrangements as of Ñscal year-end:

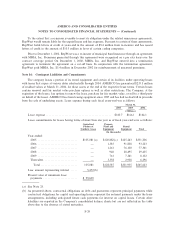

Amount

Outstanding

as of Interest Payments

March 31,

Financing Date 2004 2004 2003 2002

(In thousands)

June, 1991 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $13,538 $1,159 $978 $1,210

March, 1999ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 120 11 11 14

February, 2000ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 730 74 62 74

April, 2001 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 125 12 5 Ì

Shares are released from collateral and allocated to active employees based on the proportion of debt

service paid in the plan year. Contributions to the ESOT that were charged to expense during 2004, 2003 and

2002 were $2.1 million, $2.2 million and $2.1 million, respectively.

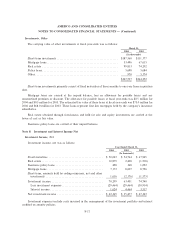

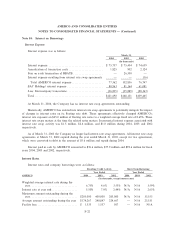

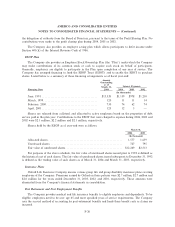

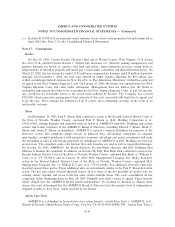

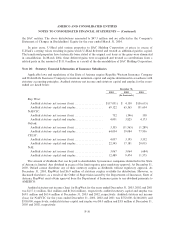

Shares held by the ESOP as of year-end were as follows:

March 31,

2004 2003

(In thousands)

Allocated shares ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,577 1,639

Unreleased shares ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 727 795

Fair value of unreleased sharesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $12,249 $2,513

For purposes of the above schedule, the fair value of unreleased shares issued prior to 1992 is deÑned as

the historical cost of such shares. The fair value of unreleased shares issued subsequent to December 31, 1992

is deÑned as the trading value of such shares as of March 31, 2004 and March 31, 2003, respectively.

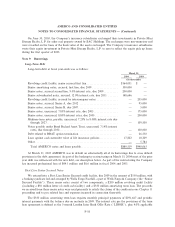

Insurance Plans

Oxford Life Insurance Company insures various group life and group disability insurance plans covering

employees of the Company. Premiums earned by Oxford on these policies were $2.7 million, $2.7 million and

$2.0 million for the years ended December 31, 2003, 2002, and 2001, respectively. These amounts were

eliminated from the Company's Ñnancial statements in consolidation.

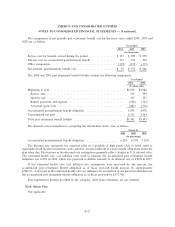

Post Retirement and Post Employment BeneÑts

The Company provides medical and life insurance beneÑts to eligible employees and dependents. To be

eligible, employees need to be over age 65 and meet speciÑed years of service requirements. The Company

uses the accrual method of accounting for post-retirement beneÑts and funds these beneÑt costs as claims are

incurred.

F-26