U-Haul 2004 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2004 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

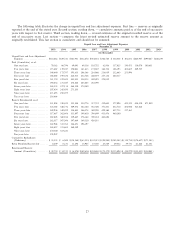

BeneÑts and losses incurred were $109.4 million, $128.7 million, and $255.8 million for the twelve months

ended December 31, 2003, 2002, and 2001, respectively. The decreases in each year are due to decreased

earned premiums in all segments of RepWest's business.

Amortization of deferred policy acquisition costs was $14.1 million, $17.3 million, and $22.1 million for

the twelve months ended December 31, 2003, 2002, and 2001, respectively. The decreases are due to

decreased premium writings.

Operating expenses, before intercompany eliminations, were $27.4 million, $37.0 million and $77.2 mil-

lion for the twelve months ended December 31, 2003, 2002, and 2001, respectively. Included in operating

expenses are commissions that were $10.3 million, $13.9 million and $51.2 million for the twelve months

ended December 31, 2003, 2002 and 2001, respectively. The decreases are due to decreased premium writings.

Pretax losses from operations were $36.0 million, $8.0 million, and $72.4 million for the twelve months

ended December 31, 2003, 2002, and 2001, respectively. The increase in losses in 2003 was due to the

development of losses on business lines that were previously written and subsequently terminated. The

decrease in losses in 2002 from 2001 was due to reduced expenses as well as improved loss development.

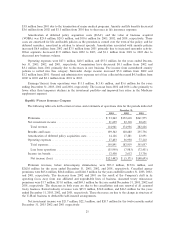

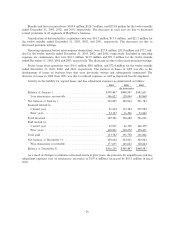

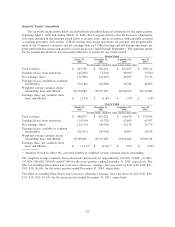

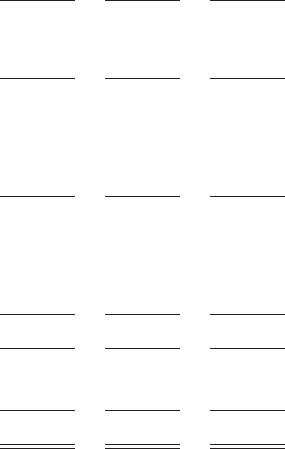

Activity in the liability for unpaid losses and loss adjustment expenses is summarized as follows:

2003 2002 2001

(In thousands)

Balance at January 1 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $399,447 $448,987 $382,651

Less reinsurance recoverable ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 146,622 128,044 80,868

Net balance at January 1ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 252,825 320,943 301,783

Incurred related to:

Current year ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 56,454 112,284 232,984

Prior years ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 53,127 16,396 23,042

Total incurred ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 109,581 128,680 256,026

Paid related to:

Current year ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 22,931 66,728 106,395

Prior years ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 100,851 130,070 130,471

Total paidÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 123,782 196,798 236,866

Net balance at December 31ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 238,624 252,825 320,943

Plus reinsurance recoverable ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 177,635 146,622 128,044

Balance at December 31 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $416,259 $399,447 $448,987

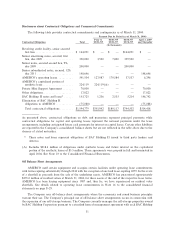

As a result of changes in estimates of insured events in prior years, the provision for unpaid losses and loss

adjustment expenses (net of reinsurance recoveries of $107.4 million) increased by $53.1 million in Ñscal

2003.

26