U-Haul 2004 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2004 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

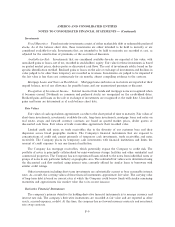

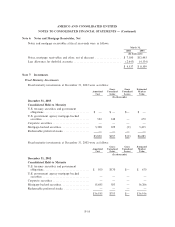

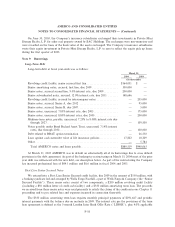

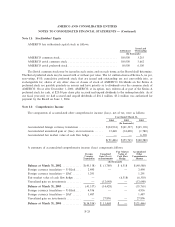

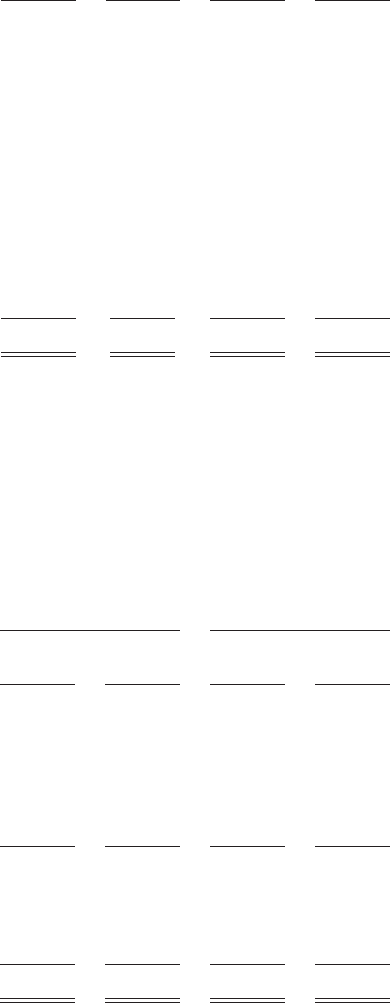

Available-for-sale investments at December 31, 2002 were as follows:

Gross Gross Estimated

Amortized Unrealized Unrealized Market

Cost Gains Losses Value

(In thousands)

December 31, 2002

Consolidated Available-for-Sale

U.S. treasury securities and government

obligations ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 31,697 $ 3,405 $ (49) $ 35,053

U.S. government agency mortgage-backed

securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 10,182 201 (13) 10,370

Obligations of states and political subdivisions ÏÏÏ 3,974 232 Ì 4,206

Corporate securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 574,334 25,996 (25,392) 574,938

Mortgage-backed securitiesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 95,893 2,206 (4,316) 93,783

Redeemable preferred stocks ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 126,301 1,558 (2,962) 124,897

Redeemable common stocksÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,101 304 (235) 1,170

$843,482 $33,902 $(32,967) $844,417

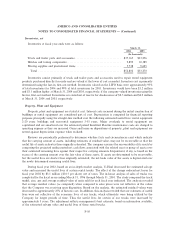

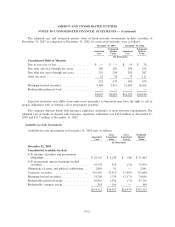

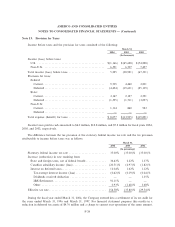

The company sold available-for-sale securities with a fair value of $267.9 million in 2003, $248.0 million

in 2002 and $175.9 million in 2001. The gross realized gains on these sales totaled $5.3 million in 2003,

$6.0 million in 2002 and $3.8 million in 2001. The company realized gross losses on these sales of $3.1 million

in 2003, $2.4 million in 2002 and $0.3 million in 2001. The company recognized a write-down of investments

due to other than temporary declines on available-for-sale investments of approximately $5.0 million in 2003,

$9.8 million in 2002 and $6.7 million in 2001.

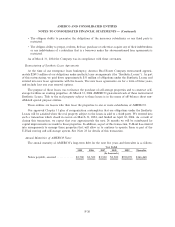

The adjusted cost and estimated market value of available-for-sale investments in debt securities at

December 31, 2003 as compared to December 31, 2002, by contractual maturity, were as follows:

December 31, 2003 December 31, 2002

Estimated Estimated

Amortized Market Amortized Market

Cost Value Cost Value

(In thousands)

Consolidated Available-for-Sale

Due in one year or less ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 50,698 $ 50,847 $ 53,240 $ 53,985

Due after one year through Ñve years ÏÏÏÏÏÏÏÏÏÏ 270,186 283,711 210,765 215,996

Due after Ñve years through ten yearsÏÏÏÏÏÏÏÏÏÏ 132,009 137,969 181,425 176,645

After ten years ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 100,888 108,795 164,575 167,571

553,781 581,322 610,005 614,197

Mortgage-backed securitiesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 74,268 74,636 106,075 104,153

Redeemable preferred stock ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 45,861 47,216 126,301 124,897

Redeemable common stock ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 243 349 1,101 1,170

$674,153 $703,523 $843,482 $844,417

F-16