U-Haul 2004 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2004 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

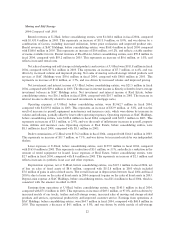

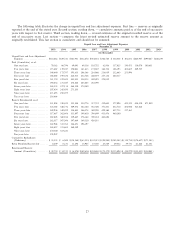

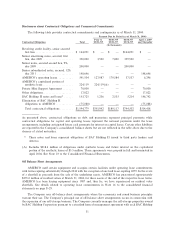

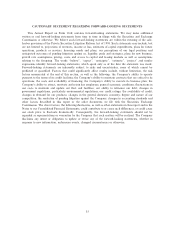

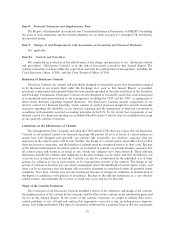

Disclosures about Contractual Obligations and Commercial Commitments

The following table provides contractual commitments and contingencies as of March 31, 2004:

Payment Due by Period (as of March 31, 2004)

Prior to 04/01/05 04/01/07 April 1, 2009

Contractual Obligations Total 03/31/05 03/31/07 03/31/09 and Thereafter

(In thousands)

Revolving credit facility, senior secured

Ñrst lien ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 164,051 $ Ì $ Ì $164,051 $ Ì

Senior amortizing notes, secured, Ñrst

lien, due 2009 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 350,000 3,500 7,000 339,500 Ì

Senior notes, secured second lien, 9%,

due 2009 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 200,000 Ì Ì 200,000 Ì

Senior subordinated notes, secured, 12%

due 2011 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 148,646 Ì Ì Ì 148,646

AMERCO's operating leasesÏÏÏÏÏÏÏÏÏÏÏ 341,504 127,087 170,584 37,537 6,296

AMERCO's capitalized portion of

synthetic lease ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 224,119 224,119(A) Ì Ì Ì

Private Mini Support Agreement ÏÏÏÏÏÏÏ 70,000 Ì Ì Ì 70,000

Other obligationsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 17,822 Ì Ì Ì 17,822

SAC Holding II notes and loans* ÏÏÏÏÏÏ 153,725 1,236 2,533 3,214 146,742

Elimination of SAC Holding II

obligations to AMERCO ÏÏÏÏÏÏÏÏÏÏÏÏ (75,088) Ì Ì Ì (75,088)

Total contractual obligations ÏÏÏÏÏÏÏÏÏ $1,594,779 $355,942 $180,117 $744,302 $314,418

As presented above, contractual obligations on debt and guarantees represent principal payments while

contractual obligations for capital and operating leases represent the notional payments under the lease

arrangements, including anticipated future cash payments for interest on capital leases. Certain other liabilities

are reported in the Company's consolidated balance sheets but are not reÖected in the table above due to the

absence of stated maturities.

* These notes and loans represent obligations of SAC Holding II issued to third party lenders and

Amerco.

(A) Includes $218.6 million of obligations under synthetic leases and future interest on the capitalized

portion of the synthetic leases of $5.5 million. These agreements were prepaid in full and terminated in

April 2004. See Note 23 to the Consolidated Financial Statements.

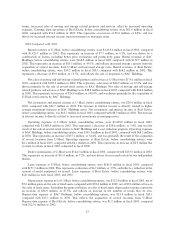

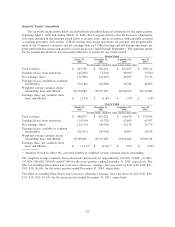

OÅ Balance Sheet Arrangements

AMERCO used certain equipment and occupies certain facilities under operating lease commitments

with terms expiring substantially through 2034 with the exception of one land lease expiring 2079. In the event

of a shortfall in proceeds from the sale of the underlying assets, AMERCO has guaranteed approximately

$235.0 million of residual values at March 31, 2004, for these assets at the end of the respective lease terms.

AMERCO has been leasing equipment since 1987 and, thus far, we have experienced no residual value

shortfalls. See details related to operating lease commitments in Note 16 to the consolidated Ñnancial

statements on page F-29.

The Company uses oÅ-balance sheet arrangements where the economics and sound business principles

warrant their use. The Company's principal use of oÅ-balance sheet arrangements occurs in connection with

the expansion of our self-storage business. The Company currently manages the self-storage properties owned

by SAC Holding Corporation pursuant to a standard form of management agreement with each SAC Holding

31