U-Haul 2004 Annual Report Download - page 72

Download and view the complete annual report

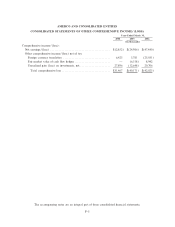

Please find page 72 of the 2004 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

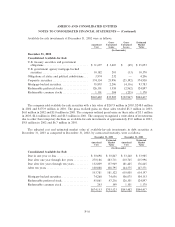

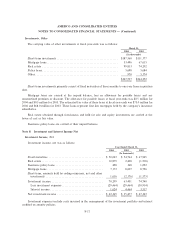

The carrying value of surplus real estate, which is lower than market value, at the balance sheet date was

$1.5 million for 2004 and 2003, and is included in the investments, other.

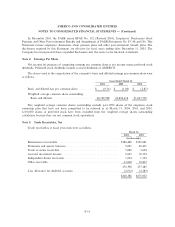

Receivables

Accounts receivable include trade accounts from self moving and self storage customers and dealers,

insurance premiums and agent balances due, net of commissions payable and amounts due from ceding

re-insurers, less management's estimate of uncollectible accounts.

Notes and mortgage receivables include accrued interest and are reduced by discounts and amounts

considered by management to be uncollectible.

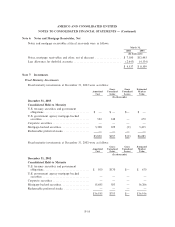

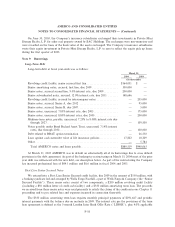

Policy BeneÑts and Losses, Claims and Loss Expenses Payable

Liabilities for life insurance and certain annuity policies are established to meet the estimated future

obligations of policies in force, and are based on mortality and withdrawal assumptions from recognized

actuarial tables which contain margins for adverse deviation.

Liabilities for annuity contracts consist of contract account balances that accrue to the beneÑt of the

policyholders, excluding surrender values. Liabilities for health, disability and other policies represents

estimates of payments to be made on insurance claims for reported losses and estimates of losses incurred, but

not yet reported.

RepWest's liability for reported and unreported losses is based on RepWest's historical and industry

averages. The liability for unpaid loss adjustment expenses is based on historical ratios of loss adjustment

expenses paid to losses paid. Amounts recoverable from reinsurers on unpaid losses are estimated in a manner

consistent with the claim liability associated with the reinsured policy. Adjustments to the liability for unpaid

losses and loss expenses as well as amounts recoverable from reinsurers on unpaid losses are charged or

credited to expense in periods in which they are made.

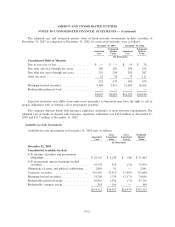

Revenue Recognition

Rental revenues are recognized over the period that trucks, moving equipment and storage space are

rented. Product sales are recognized at the time that title passes and the customer accepts delivery. Insurance

premiums are recognized over the policy periods. Interest and investment income are recognized as earned.

Advertising

All advertising costs are expensed as incurred. Advertising expense was $32.7 million in 2004,

$39.9 million in 2003 and $37.8 million in 2002.

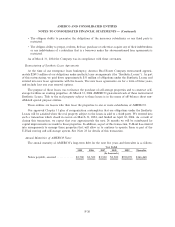

Deferred Policy Acquisition Costs

Commissions and other costs which Öuctuate with and are primarily related to the production of

insurance premiums are deferred.

For Oxford, costs are amortized in relation to revenue such that costs are realized as a constant

percentage of revenue.

For RepWest, costs are amortized over the related contract period which generally do not exceed one

year.

F-11