U-Haul 2004 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2004 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

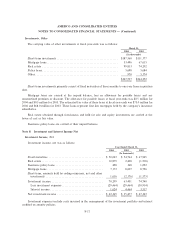

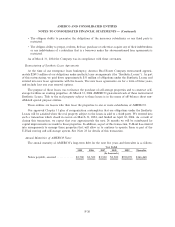

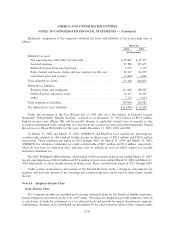

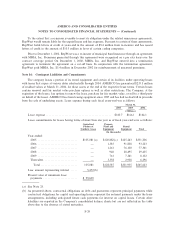

margin, the sum of which at March 31, 2004 was 5.11%. Advances under the revolving credit facility are based

on a borrowing base formula which is based on a percentage of the value of our eligible real estate. On

March 31, 2004, outstanding advances under the revolving credit facility totaled $164 million and $35 million

was available to borrow. The interest rate per the provisions of the revolving credit facility agreement is

deÑned as the prime rate (""Prime'') plus 1.5%, the sum of which at March 31, 2004 was 5.5%. The Senior

Secured Facility is secured by a Ñrst priority position in substantially all of the assets of AMERCO and its

subsidiaries, except for our notes receivable from SAC Holdings, real estate subject to synthetic leases, certain

real estate held for sale, the capital stock of our insurance subsidiaries, real property previously mortgaged to

Oxford, vehicles subject to certain lease Ñnancing arrangements, and proceeds in excess of $50 million

associated with the settlement, judgment or recovery related to our litigation against PricewaterhouseCoopers.

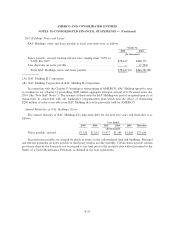

9.0% Second Lien Senior Secured Notes

AMERCO issued $200 million aggregate principal amount of 9.0% Second Lien Senior Secured Notes

due 2009. These notes represent our senior secured obligations. These notes are secured by a second priority

position in the same collateral which secures our obligations under the Senior Secured Facility.

Senior Subordinated Notes

AMERCO issued $148,646,137 aggregate principal amount of 12.0% senior subordinated notes due 2011

(the ""Senior Subordinated'') to our unsecured creditors in the Chapter 11 proceeding. No principal payments

are due on the Senior subordinated Notes until maturity. These notes, which are subordinated to all of the

senior indebtedness of AMERCO (including the Senior Secured Facility and the 9.0% Second Lien Senior

Secured Notes due 2009), are secured by certain assets of AMERCO, including the capital stock of our life

insurance subsidiary (Oxford Life Insurance Company), certain real estate held for sale, 75% of the net

proceeds in excess of $50 million associated with the settlement, judgment or recovery related to our litigation

against PricewaterhouseCoopers (after deduction of attorneys' fees and costs and taxes payable with respect to

such proceeds), and payments from notes receivable from SAC Holdings having an aggregate outstanding

principal balance at March 31, 2004 of $203.8 million.

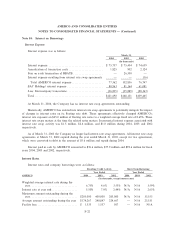

Restrictive Covenants

Under the abovementioned loan agreements, the Company is required to comply with a number of

aÇrmative and negative covenants. These covenants apply to the obligors, and provide that, among other

things:

‚ On a quarterly basis, the obligors cannot allow EBITDA minus capital expenditures (as deÑned) to fall

below speciÑed levels.

‚ The obligors are restricted in the amount of capital expenditures that they can make in any Ñscal year.

‚ The obligors ability to incur additional indebtedness is restricted.

‚ The obligors ability to create, incur, assume or permit to exist any lien on or against any of their assets

is restricted.

‚ The obligors ability to convey, sell, lease, assign, transfer or otherwise dispose of any of their assets is

restricted.

‚ The obligors cannot enter into any merger, consolidation, reorganization, or recapitalization (subject to

exceptions) and they cannot liquidate, wind up or dissolve any of their subsidiary that is a borrower

under the abovementioned loan agreements, unless the assets of the dissolved entity are transferred to

another subsidiary that is a borrower under the abovementioned loan agreements and certain other

conditions are met.

F-19