U-Haul 2004 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2004 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

Oxford Life Insurance Company (""Oxford'') and its wholly-owned subsidiaries

North American Insurance Company (""NAI'')

Christian Fidelity Life Insurance Company (""CFLIC''),

Unless the context otherwise requires, the term ""Company'' refers to AMERCO and all of its legal

subsidiaries.

Description of Operating Segments

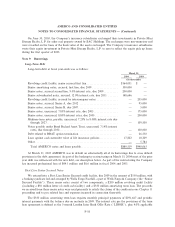

AMERCO has three reportable operating segments and Ñve identiÑable operating segments. The three

reportable segments are Moving and Self Storage, Property and Casualty Insurance and Life Insurance.

U-Haul moving and storage, Real Estate, and SAC moving and storage are separately listed under one

reportable segment, Moving and Self Storage, since they meet the aggregation criteria of FASB 131.

U-Haul moving and self-storage operations consist of the rental of trucks and trailers, sales of moving

supplies, sales of trailer hitches, sales of propane, and the rental of self-storage spaces to the ""do-it-yourself''

mover. Operations are conducted under the registered trade name U-Haul» throughout the United States and

Canada.

Real Estate owns approximately 90 percent of the Company's real estate assets, including U-Haul Center

and Storage locations. The remainder of the real estate assets are owned by various U-Haul entities. Real

Estate is responsible for overseeing property acquisitions, dispositions and managing environmental risks of the

properties.

SAC moving and self-storage operations consist of the rental of self-storage spaces, sales of moving

supplies, sales of trailer hitches, and sales of propane. In addition, SAC functions as an independent dealer and

earns commissions from the rental of U-Haul trucks and trailers. Operations are conducted under the

registered trade name U-Haul» throughout the United States and Canada.

RepWest originates and reinsures property and casualty insurance products for various market partici-

pants, including independent third parties, U-Haul's customers, and the Company.

Oxford originates and reinsures annuities, credit life and disability, life insurance, and supplemental

health products. Oxford also administers the self-insured employee health and dental plans for the Company.

Note 3: Accounting Policies

Use of Estimates

The preparation of Ñnancial statements in conformity with the accounting principles generally accepted in

the U.S. requires management to make estimates and judgments that aÅect the amounts reported in the

Ñnancial statements and accompanying notes. The accounting estimates that require management's most

diÇcult and subjective judgments include the recoverability of property, plant and equipment; the adequacy of

insurance reserves; and the recognition and measurement of income tax assets and liabilities. The actual

results experienced by the Company may diÅer from management's estimates.

Cash and Cash Equivalents

The Company considers cash equivalents to be highly liquid debt securities with insigniÑcant interest rate

risk with original maturities from the date of purchase of three months or less.

F-8