U-Haul 2004 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2004 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

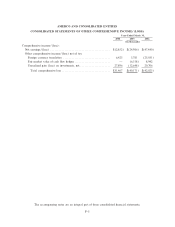

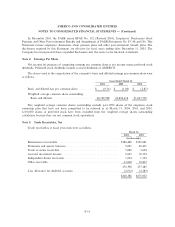

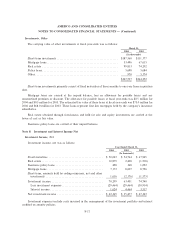

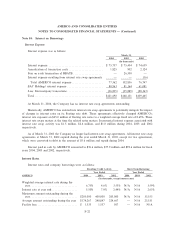

The adjusted cost and estimated market value of Ñxed maturity investments in debt securities at

December 31, 2003 as compared to December 31, 2002, by contractual maturity, were as follows:

December 31, 2003 December 31, 2002

Estimated Estimated

Amortized Market Amortized Market

Cost Value Cost Value

(In thousands)

Consolidated Held-to Maturity

Due in one year or less ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ Ì $ Ì $ 19 $ 20

Due after one year through Ñve years ÏÏÏÏÏÏÏÏÏÏÏÏ 240 283 204 252

Due after Ñve years through ten yearsÏÏÏÏÏÏÏÏÏÏÏÏ 219 294 205 287

After ten years ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 63 93 72 111

522 670 500 670

Mortgage-backed securitiesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 5,308 5,415 15,683 16,266

Redeemable preferred stock ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì Ì Ì

$5,830 $6,085 $16,183 $16,936

Expected maturities may diÅer from contractual maturities as borrowers may have the right to call or

prepay obligations with or without call or prepayment penalties.

The company deposits bonds with insurance regulatory authorities to meet statutory requirements. The

adjusted cost of bonds on deposit with insurance regulatory authorities was $12.9 million at December 31,

2003 and $11.7 million at December 31, 2002.

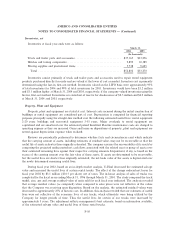

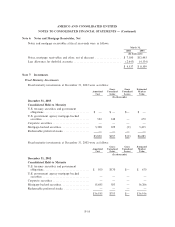

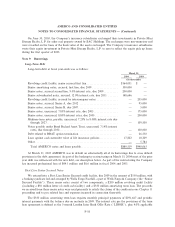

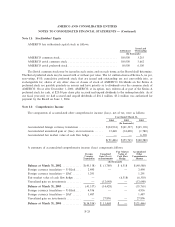

Available-for-Sale Investments

Available-for-sale investments at December 31, 2003 were as follows:

Gross Gross Estimated

Amortized Unrealized Unrealized Market

Cost Gains Losses Value

(In thousands)

December 31, 2003

Consolidated Available-for-Sale

U.S. treasury securities and government

obligations ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 29,765 $ 2,134 $ (36) $ 31,863

U.S. government agency mortgage-backed

securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 10,570 316 (12) 10,874

Obligations of states and political subdivisions ÏÏÏ 2,850 91 Ì 2,941

Corporate securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 510,596 32,515 (7,467) 535,644

Mortgage-backed securitiesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 74,268 1,739 (1,371) 74,636

Redeemable preferred stocks ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 45,861 1,426 (71) 47,216

Redeemable common stocks ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 243 106 Ì 349

$674,153 $38,327 $(8,957) $703,523

F-15