U-Haul 2004 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2004 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of management, including the CEO and the CFO, concerning the eÅectiveness of the controls can be reported

in our Quarterly Reports on Form 10-Q and to supplement our disclosures made in our Annual Report on

Form 10-K. Many of the components of our Disclosure Controls are evaluated on an on-going basis by

personnel in our Ñnance department, as well as our independent auditors who evaluate them in connection

with determining their auditing procedures related to their report on our annual Ñnancial statements. The

overall goals of these various evaluation activities are to monitor our Disclosure Controls, and to modify them

as necessary. Our intent is to maintain the Disclosure Controls as dynamic systems that change as conditions

warrant.

Among other matters, we also considered whether our evaluation identiÑed any ""signiÑcant deÑciencies''

or ""material weaknesses'' in our internal control over Ñnancial reporting, and whether the company had

identiÑed any acts of fraud involving personnel with a signiÑcant role in our internal control over Ñnancial

reporting. This information was important both for the controls evaluation generally, and because item 5 of the

certiÑcations of the CEO and the CFO requires that the CEO and the CFO disclose that information to the

Audit Committee of our Board and the independent auditors. In the professional auditing literature,

""signiÑcant deÑciencies'' are referred to as ""reportable conditions,'' which are deÑciencies in the design or

operation of controls that could adversely aÅect our ability to record, process, summarize and report Ñnancial

data in the Ñnancial statements. Auditing literature deÑnes ""material weakness'' as a particularly serious

reportable condition in which the internal control does not reduce to a relatively low level the risk that

misstatements caused by error or fraud may occur in amounts that would be material in relation to the

Ñnancial statements and the risk that such misstatements would not be detected within a timely period by

employees in the normal course of performing their assigned functions. Based upon our evaluation of the

eÅectiveness of the Company's internal controls, management has concluded that there were deÑciencies in

the design and operation of internal controls that adversely aÅected our ability to record, process and

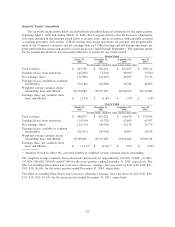

summarize and report Ñnancial data related to: SAC Holding I and SAC Holding II Corporation account

analyses, and general ledger reconciliation and segregation of the Canadian general ledger into local currency.

These deÑciencies were considered to be material weaknesses under the standards established by the

American Institute of CertiÑed Public Accountants. As a result of the conclusions discussed above, under the

direction of the Audit Committee and the Board of Directors, we have taken corrective action to strengthen

our internal controls and procedures to ensure information required to be disclosed in the reports we Ñle or

submit under the Securities Exchange Act of 1934 is recorded, processed, summarized and accurately

reported, within the time periods speciÑed in the SEC's rules and forms. We also sought to address other

control matters in the control evaluation, and in each case if a problem was identiÑed, we considered what

revision, improvement and/or correction to make in accordance with our on-going procedures.

Changes in Internal Control Over Financial Reporting

During the last Ñscal quarter covered by this report we made no change in our internal control over

Ñnancial reporting which materially aÅected, or is reasonably likely to materially aÅect, our internal control

over Ñnancial reporting.

Conclusions

Based upon the controls evaluation, our CEO and CFO have concluded that, subject to the limitations

noted above, as of the end of the period covered by this Annual Report, our Disclosure Controls were eÅective

to provide reasonable assurance that material information relating to AMERCO and its consolidated

subsidiaries is made known to management, including the CEO and the CFO, particularly during the period

when our periodic reports are being prepared.

40