Tesco 2007 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2007 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

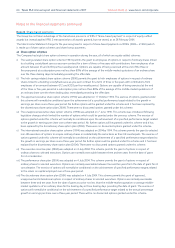

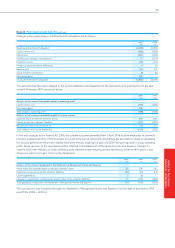

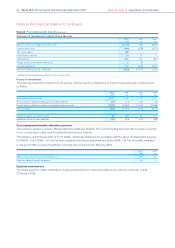

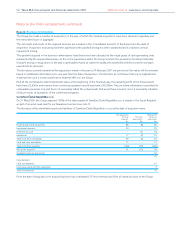

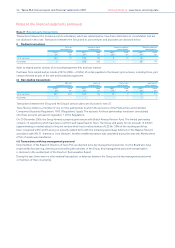

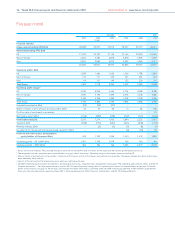

Note 25 Statement of changes in equity continued

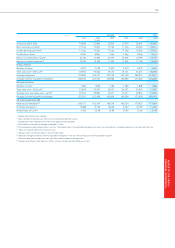

Share premium account

The share premium account is used to record amounts received in excess of the nominal value of shares on issue of new shares.

Translation reserve

The translation reserve is used to record exchange differences arising from the translation of the financial statements of foreign

subsidiaries. It is also used to record the movements in net investment hedges.

Treasury shares

During the year, the qualifying employee share ownership trust (QUEST) subscribed for 1.5 million shares from the Company,

a negligible percentage of called-up share capital as at 24 February 2007 (2006 – 10 million, 0.1%). There were no contributions

(2006 – £12m) to the QUEST from subsidiary undertakings.

The employee benefit trusts hold shares in Tesco PLC for the purpose of the various executive share incentive and profit share

schemes. At 24 February 2007, the trusts held 57.0 million shares (2006 – 48.4 million), which cost £184m (2006 – £140m) and

had a market value of £254m (2006 – £163m).

Merger reserve

The merger reserve arose on the acquisition of Hillards PLC in 1987.

Other

The cumulative goodwill written-off against the reserves of the Group as at 24 February 2007 amounted to £718m (2006 – £718m).

89

NOTES TO THE GROUP

FINANCIAL STATEMENTS