Tesco 2007 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2007 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

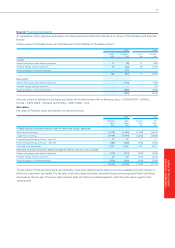

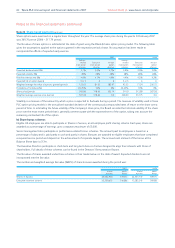

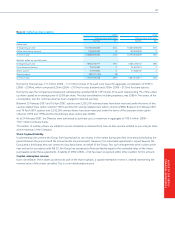

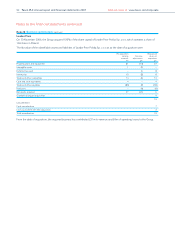

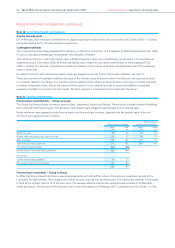

Note 24 Called up share capital

2007 2006

Ordinary shares of 5p each Ordinary shares of 5p each

Number £m Number £m

Authorised:

At beginning of year 10,700,000,000 535 10,600,000,000 530

Authorised during the year 158,000,000 8 100,000,000 5

At end of year 10,858,000,000 543 10,700,000,000 535

Allotted, called up and fully paid:

At beginning of year 7,894,476,917 395 7,783,169,542 389

Scrip dividend election 75,205,082 3 53,639,219 3

Share options 75,994,892 4 57,668,156 3

Share buyback (98,327,333) (5) – –

At end of year 7,947,349,558 397 7,894,476,917 395

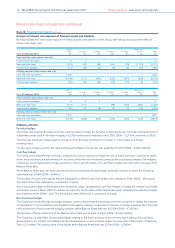

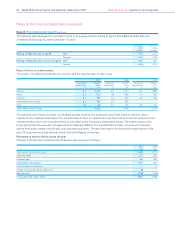

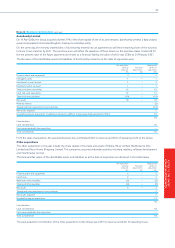

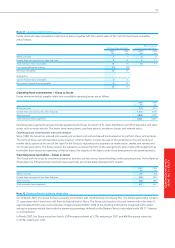

During the financial year, 151 million (2006 – 111 million) shares of 5p each were issued for aggregate consideration of £395m

(2006 – £290m), which comprised £239m (2006 – £167m) for scrip dividend and £156m (2006 – £123m) for share options.

During the year, the Company purchased and subsequently cancelled 98,327,333 shares of 5p each (representing 1% of the called

up share capital) at an average price of £3.89 per share. The total consideration, including expenses, was £385m. The excess of the

consideration over the nominal value has been charged to retained earnings.

Between 25 February 2007 and 16 April 2007, options over 3,263,739 ordinary shares have been exercised under the terms of the

savings-related share option scheme (1981) and the Irish savings-related share option scheme (2000). Between 25 February 2007

and 16 April 2007, options over 2,242,269 ordinary shares have been exercised under the terms of the executive share option

schemes (1994 and 1996) and the discretionary share option plan (2004).

As at 24 February 2007, the Directors were authorised to purchase up to a maximum in aggregate of 790.5 million (2006 –

778.7 million) ordinary shares.

The holders of ordinary shares are entitled to receive dividends as declared from time-to-time and are entitled to one vote per share

at the meetings of the Company.

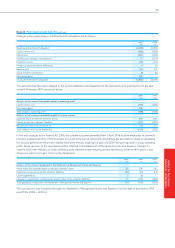

Share buyback liability

Insider trading rules prevent the Group from buying back its own shares in the market during specified close periods (including the

period between the year end and the annual results announcement). However, if an irrevocable agreement is signed beween the

Group and a third party, they can continue to buy back shares on behalf of the Group. Two such arrangements were in place at the

year end and in accordance with IAS 32, the Group has recognised a financial liability equal to the estimated value of the shares

purchasable under these agreements. A liability of £90m (2006 – £nil) has been recognised within other creditors for this amount.

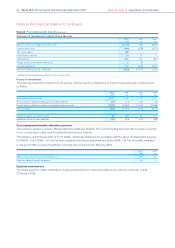

Capital redemption reserve

Upon cancellation of the shares purchased as part of the share buyback, a capital redemption reserve is created representing the

nominal value of the shares cancelled. This is a non-distributable reserve.

87

NOTES TO THE GROUP

FINANCIAL STATEMENTS