Tesco 2007 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2007 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4Tesco PLC Annual report and financial statements 2007 Find out more at www.tesco.com/corporate

Group performance

These results represent very good progress across

the Group and have been achieved by investing

to improve the shopping experience for

customers in our businesses around the world.

We have been able to deliver another solid sales

performance, and through good cost control and

productivity improvements we have grown profits

faster than revenue – and thereby improved

returns for shareholders. These improvements

have been achieved whilst continuing to invest in

the long term – in the people, assets, processes

and systems, which will enable Tesco to sustain

its success in the future.

Group These results are for the 52 weeks ended

24 February 2007, compared with the equivalent

52-week period for the UK and the Republic of

Ireland combined with the 60-week period to

the end of February 2006 for the majority of

the international businesses. Where appropriate,

and for ease of comparison, total Group and

segmental results are also reported against a

comparable 52-week period to 25 February 2006.

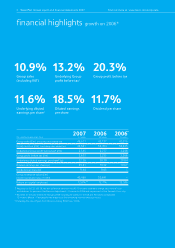

Group sales, including VAT, increased by 8.1%

to £46.6bn (last year £43.1bn) and by 10.9%

on a comparable 52-week basis. At constant

exchange rates, sales increased by 7.9% and

10.8% respectively.

Last April, with our Preliminary Results for

2005/06, and following our transition to IFRS,

we introduced an underlying profit measure,

which excludes the impact of the volatile non-

cash elements of IAS 19, IAS 32 and IAS 39

(principally pension costs and the marking to

market of financial instruments). Underlying

profit rose to £2,545m in the year, an increase

of 13.2% on a comparable 52-week basis. This

includes, as usual, property profits but excludes

both the gain in the year from the Finance Act

2006 pensions adjustment (Pensions A-Day)

and the impairment charge on our Gerrards

Cross site.

With our Interim Results for 2006/07, we also

began reporting segmental trading profit, which

excludes property profits and, as our underlying

profit measure does, also excludes the non-cash

element of the IAS 19 pension charge. In the

current year this measure also excludes the

Pensions A-Day gain and the impairment

charge on Gerrards Cross. Group trading profits

were £2,478m, up 11.1% on last year on a

comparable basis.

Group operating profit rose by 17.7% to

£2,648m. Total net Group property profits were

£139m, comprising £98m in the UK, a £6m loss

in Asia and a £47m profit within Joint Ventures

and Associates.

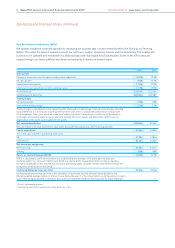

Comparable Basis Statutory Basis

52 weeks vs 52 weeks vs

52 weeks 60 weeks

Actual rates Actual rates Constant Actual rates

Group sales (inc. VAT) £46,611m 10.9% 10.8% 8.1%

Group profit before tax £2,653m 20.3% 19.9% 18.7%

Group operating profit £2,648m 17.7% 17.4% 16.1%

Group underlying profit £2,545m 13.2% 12.9% 11.8%

Group trading profit £2,478m 11.1% 10.8% 9.6%

Trading margin 5.8%–––

03 04 0605

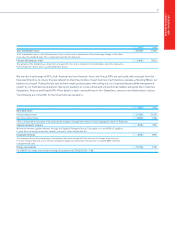

CAPITAL EXPENDITURE

£m

2,134 1,228

2,285 1,520

07

2,802 1,795

2,990 1,883

2,450 1,704

GROUP

UK

Operating and financial review continued