Tesco 2007 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2007 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the financial statements continued

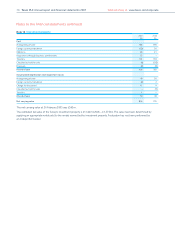

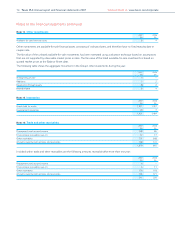

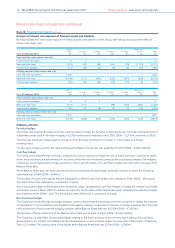

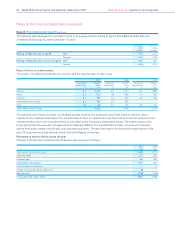

Note 19 Borrowings continued

Non-current

Effective

interest rate

Effective after hedging

interest rate transactions Maturity 2007 2006

Par value % % year £m £m

Finance leases (note 31) – 9.2 9.2 – 147 84

7.5% MTN £325m––––344

6% MTN (b) £125m 6.0 5.9 2008 130 268

5.25% MTN €500m 5.3 6.0 2008 352 366

5.125% MTN (c) £192m 5.1 5.8 2009 190 355

6.625% MTN £150m 6.7 6.7 2010 153 153

4.75% MTN €750m 4.8 6.2 2010 525 548

3.875% MTN €500m 3.9 5.9 2011 340 –

4% RPI MTN (d) £238m 6.6 6.6 2016 244 236

5.5% MTN £350m 5.6 5.6 2019 349 349

5% MTN £350m 5.1 5.1 2023 361 –

3.322% LPI MTN (e) £241m 5.9 5.9 2025 243 236

6% MTN £200m 6.0 6.0 2029 198 214

5.5% MTN £200m 5.6 5.6 2033 197 213

2% RPI MTN £204m 4.6 4.6 2036 206 –

5% MTN £300m 5.1 5.1 2042 306 –

Other MTNs – 2.2 2.2 – 176 278

Other loans – 4.9 4.9 2008 29 98

4,146 3,742

(b) The par value has been reduced from £250m in 2006 to £125m in 2007 by a buyback of part of the MTN.

(c) The par value has been reduced from £350m in 2006 to £192m in 2007 by a buyback of part of the MTN.

(d) The 4% RPI MTN is redeemable at par, indexed for increases in the Retail Price Index over the life of the MTN.

(e) The 3.322% LPI MTN is redeemable at par, indexed for increases in the RPI over the life of the MTN. The maximum indexation of the principal in any one year is 5%,

with a minimum of 0%.

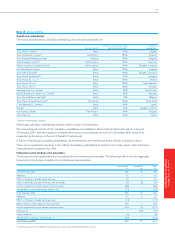

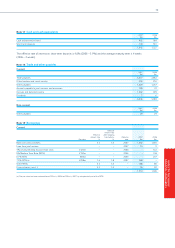

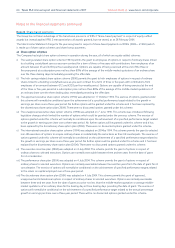

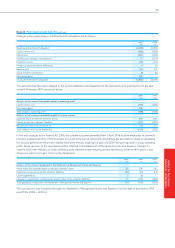

Borrowing facilities

The Group has the following undrawn committed facilities available at 24 February 2007, in respect of which all conditions

precedent had been met as at that date:

2007 2006

£m £m

Expiring within one year ––

Expiring between one and two years ––

Expiring in more than two years 1,750 1,750

1,750 1,750

All facilities incur commitment fees at market rates and would provide funding at floating rates.

76 Tesco PLC Annual report and financial statements 2007 Find out more at www.tesco.com/corporate