Tesco 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

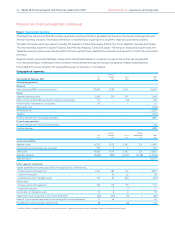

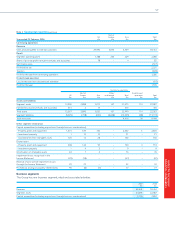

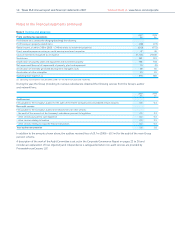

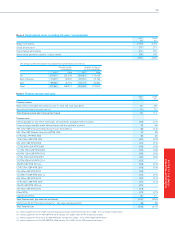

Notes to the Group financial statements continued

Note 1 Accounting policies continued

54 Tesco PLC Annual report and financial statements 2007 Find out more at www.tesco.com/corporate

Treatment of agreements to acquire minority interests

The Group has entered into a number of agreements to

purchase the remaining shares of subsidiaries with minority

shareholdings.

Under IAS 32 ‘Financial Instruments: Disclosures’, the net

present value of the expected future payments are shown as

a financial liability. At the end of each period, the valuation of

the liability is reassessed with any changes recognised in the

Income Statement within finance costs for the year. Where the

liability is in a currency other than Pounds Sterling, the liability

has been designated as a net investment hedge. Any change

in the value of the liability resulting from changes in exchange

rates is recognised directly in equity.

Provisions

Provisions for onerous leases are recognised when the Group

believes that the unavoidable costs of meeting the lease

obligations exceed the economic benefits expected to be

received under the lease.

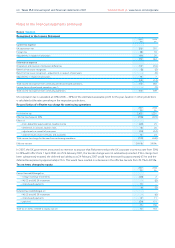

Recent accounting developments

Standards, amendments and interpretations effective for

2006/07 with no significant impact on the Group:

The following standards, amendments and interpretations are

mandatory for accounting periods beginning on or after

1 January 2006, however, their implementation has not had

a significant impact on the results or net assets of the Group:

• Amendment to IAS 21 ‘Net investment in foreign

operation’

• Amendment to IAS 39 ‘Financial Instruments: Recognition

and Measurement’ and IFRS 4 ‘Insurance Contracts’ on

Financial Guarantee Contracts

• Amendment to IAS 39 on the fair value option

• Amendment to IAS 39 on cash flow hedge accounting

of forecast intragroup transactions

• IFRIC 4 ‘Determining whether an arrangement contains

a lease’

• IFRIC 5 ‘Rights to interests arising from decommissioning,

restoration and environmental rehabilitation funds’

Standards, amendments and interpretations not yet effective

but not expected to have a significant impact on the Group:

• IFRS 7 ‘Financial Instruments: Disclosures’ and

amendments to IAS 1 ‘Presentation of Financial

Statements – Capital Disclosures’ were issued in August

2005 and are effective for accounting periods beginning

on or after 1 January 2007. These amendments revise

and enhance previous disclosures required by IAS 32 and

IAS 30 ‘Disclosures in the Financial Statements of Banks

and Similar Financial Institutions’. The adoption of

IFRS 7 will have no impact on the results or net

assets of the Group.

• IFRS 8 ‘Operating Segments’ was issued in November

2006 and is effective for accounting periods beginning

on or after 1 January 2009. This new standard replaces

IAS 14 ‘Segment Reporting’ and requires segmental

information to be presented on the same basis that

management uses to evaluate performance of its reporting

segments in its management reporting. The adoption of

IFRS 8 will have no impact upon the results or net assets

of the Group.

• IFRIC 7 ‘Applying IAS 29 ‘Hyperinflationary accounting’

for the first time’

• IFRIC 8 ‘Scope of IFRS 2’

• IFRIC 9 ‘Reassessment of embedded derivatives’

• IFRIC 10 ‘Interim financial reporting and impairment’

• IFRIC 12 ‘Service concession arrangements’

Standards, amendments and interpretations not yet effective

and under review as to their effect on the Group:

• IFRIC 6 ‘Liabilities arising from participating in a specific

market – waste electrical and electronic equipment (WEEE)’

– effective from 1 July 2007 (date from which the WEEE

Directive is applicable in the UK)

• IFRIC 11 ‘Scope of IFRS 2 – Group and treasury share

transactions’ – effective for periods beginning on or after

1 March 2007

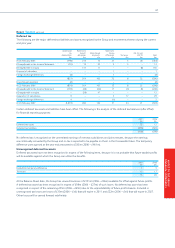

Use of non-GAAP profit measures – underlying profit

before tax

The Directors believe that underlying profit before tax and

underlying diluted earnings per share measures provide

additional useful information for shareholders on underlying

trends and performance. These measures are used for internal

performance analysis. Underlying profit is not defined by IFRS

and therefore may not be directly comparable with other

companies’ adjusted profit measures. It is not intended to be

a substitute for, or superior to IFRS measurements of profit.

The adjustments made to reported profit before tax are:

• IAS 32 and IAS 39 ‘Financial Instruments’ – fair value

remeasurements – under IAS 32 and IAS 39, the Group

applies hedge accounting to its various hedge relationships

when allowed under the rules of IAS 39 and when practical

to do so. Sometimes the Group is unable to apply hedge

accounting to the arrangements, but continues to enter

into these arrangements as they provide certainty or active

management of the exchange rates and interest rates

applicable to the Group. The Group believes these

arrangements remain effective and economically and

commercially viable hedges despite the inability to apply

hedge accounting.