Tesco 2007 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2007 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Operating and financial review continued

16 Tesco PLC Annual report and financial statements 2007 Find out more at www.tesco.com/corporate

Suppliers & Farmers

• We are committed to increasing the number of local

products in store. Regional roadshows in Cornwall, the

Isle of Wight, the North-West and Wales attracted over

300 small suppliers and we have already launched 58

new lines in our South West stores as a result of the

roadshow in Cornwall.

• We will help dairy farmers by offering direct contracts to

named farmers, raising the price they receive to around 22

pence per litre, and sourcing more for our ‘Localchoice’ milk

from local farms – this will be sold for slightly more per litre

than standard milk so that these smaller producers can

make returns more in line with the proportionately higher

costs of their business.

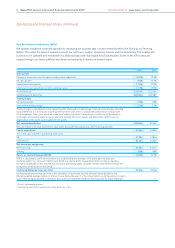

Risks and uncertainties

Introduction Risk is an accepted part of doing business. The

real challenge for any business is to identify the principal risks

and to develop and monitor appropriate controls. A successful

risk management process balances risks and rewards and relies

on a sound judgement of their likelihood and consequence.

The Tesco Board has overall responsibility for risk management

and internal control within the context of achieving the Group’s

objectives. Our process for identifying and managing risks is set

out in more detail on page 24 of the Corporate Governance

Statement in this Annual Report. The key risks and mitigating

factors are set out below.

Business strategy If our strategy follows the wrong direction or

is not efficiently communicated then the business may suffer.

We need to understand and properly manage strategic risk in

order to deliver long-term growth for the benefit of all our

stakeholders. Our strategy is based on a four-part strategy:

to grow the core UK business, be as strong in non-food as

in food, develop retailing services and become a successful

international retailer. Pursuit of this four-part strategy has

allowed the business to diversify. At a strategic level,

diversification and pursuit of growth in emerging markets has

the effect of reducing overall risk by avoiding reliance on a

small number of business areas. However, by its very nature,

diversification also introduces new risks to be managed in

areas of the business that are less mature and fully understood.

To ensure the Group continues to pursue the right strategy,

we dedicate two full days a year to reviewing strategy as well as

discussing it at every Board meeting. The Executive Committee

also holds specific sessions on a regular basis. We have

structured programmes for engaging with all our stakeholders

including customers, employees, investors, suppliers,

government, media and non-governmental organisations.

We also invest significant resources in ensuring our strategy

is communicated well and understood by the parties who are

key to delivering it. The business operates a ‘Steering Wheel’ –

a balanced scorecard process – in all countries and significant

business units such as Dotcom to help manage performance

and deliver business strategy.

Financial strategy and Group Treasury Risk The main

financial risks of the Group relate to the availability of funds to

meet business needs, the risk of default by counter-parties to

financial transactions, and fluctuations in interest and foreign

exchange rates.

The Treasury function is mandated by the Board to manage

the financial risks that arise in relation to underlying business

needs. The function has clear policies and operating

parameters, and its activities are routinely reviewed and

audited. The function does not operate as a profit centre and

the undertaking of speculative transactions is not permitted.

A description of the role of the Finance Committee and

Internal and External Audit is set out in the Corporate

Governance section, page 25 of the Annual Report.

Operational threats and performance risk in the business

There is a risk that our business may not deliver the stated

strategy in full particularly since, like all retailers, the business is

susceptible to economic downturn that could affect consumer

spending. The continuing acquisition and development of

property sites also forms an intrinsic part of our strategy and

this carries inherent risks.

We try to deliver what customers want better than our

competitors by understanding and responding to their

behaviour. All of our business units have stretching targets

based on the Steering Wheel and the performance of all

business units is monitored continually and reported monthly

to the Board. We manage the acquisition and development of

our property assets carefully. We consider and assess in detail

every site at each stage of acquisition and development and

ensure that relevant action is taken to minimise any risks.

Our aim is to have broad appeal to all customers in our

different markets, minimising the impact of changes to the

economic climate.

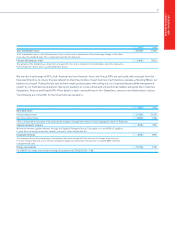

Competition and consolidation The retail industry is highly

competitive. The Group competes with a wide variety of

retailers of varying sizes and faces increased competition from

UK retailers as well as international operators here and overseas.