Tesco 2007 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2007 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106 Tesco PLC Annual report and financial statements 2007 Find out more at www.tesco.com/corporate

Notes to the Parent company financial statements continued

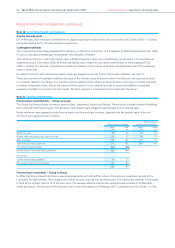

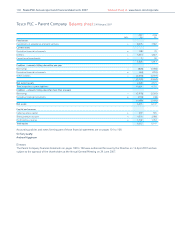

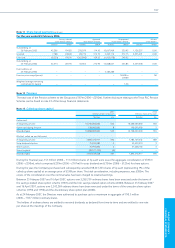

Note 10 Derivative financial instruments continued

Hedging activities

Fair value hedges

The Company uses interest rate swaps and cross-currency swaps to hedge the fair value of fixed rate bonds. The total notional

amount of outstanding swaps used for fair value hedging is £2,196m with various maturities out to 2033 (2006 – £2,703m;

maturities to 2033).

The fixed rate bonds are hedged against changes to their fair value resulting from changes in interest rates and foreign

exchange rates.

The fair value of swaps used for fair value hedging at the Balance Sheet date was a liability of £107m (2006 – £100m liability).

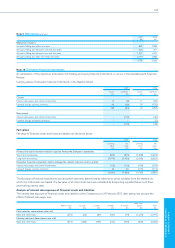

Cash flow hedges

The Company uses forward foreign exchange contracts and currency options to hedge the cost of future purchases of goods for

resale, where those purchases are denominated in a currency other than the functional currency of the Company. The hedging

instruments are primarily used to hedge purchases in Euros and US Dollars. The cash flows hedged will occur within one year of

the Balance Sheet date.

At the Balance Sheet date, the total notional amount of outstanding forward foreign exchange contracts to which the Group has

committed was £764m (2006 – £548m).

The fair value of currency derivatives that are designated as effective cash flow hedges was a liability of £24m (2006 – £4m asset).

This amount has been deferred as a component of equity.

Also in place at the Balance Sheet date were interest rate swaps, designated as cash flow hedges, to hedge the interest cost of debt

instruments issued in March 2007. The fair value of the interest rate swaps designated as cash flow hedges was a liability of £8m

(2006 – £nil). This amount has been deferred as a component of equity.

Net investment hedges

The Company uses forward foreign exchange contracts, currency denominated borrowings and currency options to hedge the

exposure of a proportion of its non-Sterling denominated assets against changes in value due to changes in foreign exchange rates.

The total notional amount of net investment hedging contracts at the Balance Sheet date was £4,250m (2006 – £3,463m).

The fair value of these instruments at the Balance Sheet date was an asset of £56m (2006 – £117m liability).

Financial instruments not qualifying for hedge accounting

The Company has a number of financial instruments which do not meet the criteria for hedge accounting. These instruments

include forward foreign exchange contracts, currency options, caps, collars and interest rate swaps. The fair value of these

instruments at the Balance Sheet date was an asset of £11m (2006 – £5m liability).

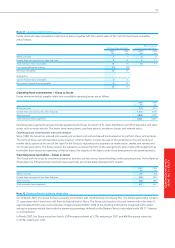

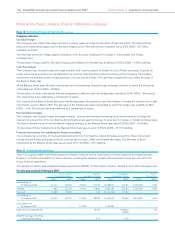

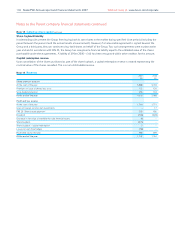

Note 11 Share-based payments

Tesco PLC’s equity settled share-based payment schemes comprise various share option schemes designed to reward Executive

Directors. For further information on these schemes, including the valuation models and assumptions used, see note 22 to the

Group financial statements.

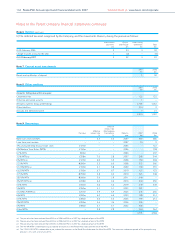

The number of options and weighted average exercise price (WAEP) of share option schemes relating to Tesco PLC’s employees are:

For the year ended 24 February 2007

Savings-related Approved Unapproved Nil cost

share option scheme share option scheme share option scheme share options

Options WAEP Options WAEP Options WAEP Options WAEP

Outstanding at

25 February 2006 42,474 203.95 43,965 272.93 12,068,027 245.83 3,459,458 0.00

Granted 7,462 307.00 9,416 318.60 2,664,782 318.60 2,350,549 0.00

Exercised (7,687) 198.00 – 0.00 (3,432,462) 219.84 – –

Outstanding at

24 February 2007 42,249 223.23 53,381 280.99 11,300,347 270.90 5,810,007 0.00

Exercisable as at

24 February 2007 – – 15,189 – 3,726,996–––

Exercise price range (pence) – – – 197.50 – 164.00 to – Nil

259.00

Weighted average remaining

contractual life (years) – – – 6.16 – 4.58 – –