Tesco 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

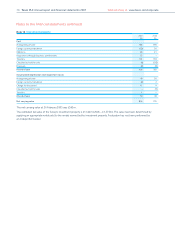

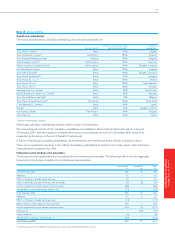

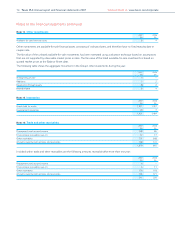

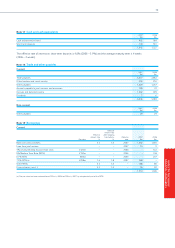

Notes to the financial statements continued

Note 13 Group entities continued

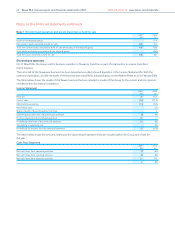

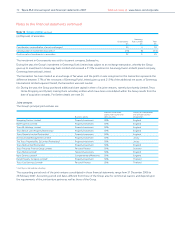

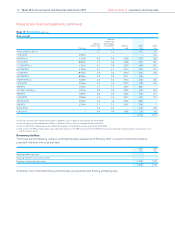

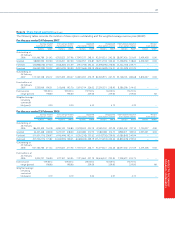

(a) Disposals of associates

Greenergy

Groceryworks Fuels Limited Total

£m £m £m

Consideration received/value of assets exchanged 35 4 39

Carrying value of investment disposed of (13) (1) (14)

Profit on sale of investments in associates 22 3 25

The investment in Groceryworks was sold to its parent company, Safeway Inc.

During the year, the Group’s investment in Greenergy Fuels Limited was subject to an exchange transaction, whereby the Group

gave up its investment in Greenergy Fuels Limited and received a 21.3% investment in Greenergy Fuels Limited’s parent company,

Greenergy International Limited.

The transaction has been treated as an exchange of fair values and the profit on sale recognised on this transaction represents the

difference between 3.7% of the net assets of Greenergy Fuels Limited given up and 21.3% of the additional net assets of Greenergy

International Limited acquired. Overall, the transaction was cash neutral.

(b) During the year, the Group purchased additional share capital in three of its joint ventures, namely dunnhumby Limited, Tesco

Home Shopping and Hymall, making them subsidiary entities which have been consolidated within the Group results from the

date of acquisition onwards. For further details see note 26.

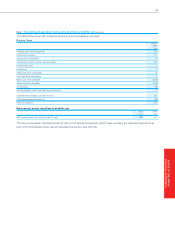

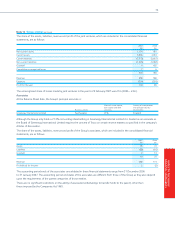

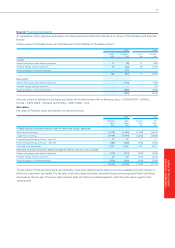

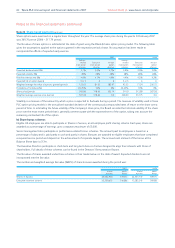

Joint ventures

The Group’s principal joint ventures are:

Share of issued share Country of incorporation

capital, loan capital and and principal country

Business activity debt securities of operation

Shopping Centres Limited Property Investment 50% England

BLT Properties Limited Property Investment 50% England

Tesco BL Holdings Limited Property Investment 50% England

Tesco British Land Property Partnership†Property Investment 50% England

Tesco Property Limited Partnership†Property Investment 50% England

Arena (Jersey) Management Limited†Property Investment 50% Jersey

The Tesco Property (No. 2) Limited Partnership†Property Investment 50% Jersey

Tesco Red Limited Partnership†Property Investment 50% England

Tesco Personal Finance Group Limited Personal Finance 50% Scotland

Tesco Mobile Limited†Telecommunications 50% England

Nutri Centres Limited†Complementary Medicines 50% England

Retail Property Company Limited†Property Investment 50% Thailand

Tesco Card Services Limited†Personal Finance 50% Thailand

†Held by an intermediate subsidiary.

The accounting period ends of the joint ventures consolidated in these financial statements range from 31 December 2006 to

28 February 2007. Accounting period end dates different from those of the Group arise for commercial reasons and depend upon

the requirements of the joint venture partner as well as those of the Group.

72 Tesco PLC Annual report and financial statements 2007 Find out more at www.tesco.com/corporate