Suzuki 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 SUZUKI MOTOR CORPORATION

Consolidated Financial Statements of 2009

Millions of Thousands of

yen U.S. dollars

Year-end cash dividends ............................................................ ¥3,477 $35,401

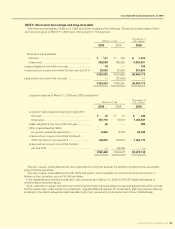

NOTE 16: Subsequent events

(a) The following plan for the profit distribution for the year ended March 31, 2009 was approved by the ordinary

general meeting of shareholders of the Company held on June 26, 2009. As a result, annual dividend including

interim dividend (8 yen per share) shall be 16 yen per share, the same as the previous fiscal year:

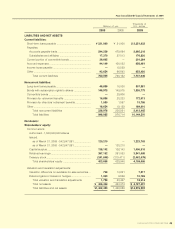

(b) On June 1, 2009 (local time in the USA), General Motors Corporation (“GM”), a trading partner of Suzuki Motor

Corporation (“Suzuki”), filed for Chapter 11 bankruptcy-court protection of the U.S. Bankruptcy Code. The Suzuki

Group has no receivables owed by GM, and receivables owed by GM’s affiliated companies that may become

uncollectible or their collection may be delayed according as the progress of GM’s bankruptcy reorganization are as

follows.

[Outline of GM]

(1) Trade name: General Motors Corporation

(2) Headquarters: 300 Renaissance Center P.O. Box 300, Detroit, MI 48265-3000, USA

(3) Representative: President and Chief Executive Officer

Frederick A. Henderson

(4) Capital: US$1,017 million (as of December 31, 2008)

(5) Main business: Development, manufacture and sale of automobiles

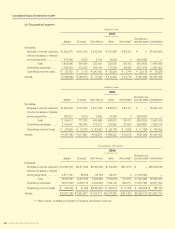

[Type and Amount of Receivables owed by GM and its affiliated companies (as of May 27, 2009) and Percentage to

Consolidated Net Assets]

(1) Receivables owed by GM and its affiliated companies in the United States

Suzuki and its affiliated companies’ receivables owed by GM

and its affiliated companies in the United States: None

(2) Receivables owed by CAMI Automotive Inc. *1

(i) Suzuki’s accounts receivables ¥ 0.2 billion

(ii) Suzuki’s investment in capital (book value) ¥ 4.1 billion

(iii) Suzuki’s guaranty of liabilities ¥ 38.1 billion (US$400 million)

(3) Receivables (relating to OPEL brand OEM vehicles) owed by General Motors Espana, S.L. (GM’s subsidiary

company)

Suzuki’s subsidiary companies’ receivables ¥ 5.8 billion (EUR43 million)

(4) Receivables owed by other GM affiliated companies

(i) Suzuki’s accounts receivables ¥ 4.0 billion

(Mortgaged receivables included) (¥ 3.8 billion)

(ii) Suzuki’s mortgage loan receivable ¥ 19.0 billion (US$200 million)

(iii) Suzuki’s subsidiary companies’ accounts receivables ¥ 0.4 billion

[Notes]*1: CAMI Automotive Inc. is a subsidiary company of General Motors of Canada Ltd. (GM’s subsidiary company),

and a joint venture of Suzuki with 49.99% share. The said company has ¥6.7 billion (CAN$78 million as of April

30, 2009) of receivables owed by General Motors of Canada Ltd.

[Notes]*2: Yen amount is calculated at the foreign exchange rates ¥95.14 (TTM) to US$ etc as of May 27, 2009.

(5) Percentage to Suzuki’s consolidated net assets at end of the previous fiscal year (March 31, 2009)

Suzuki’s consolidated net assets ¥742.9 billion

Suzuki and its subsidiaries’ receivables 3.96%

Suzuki’s investment in capital 0.55%

Suzuki’s guaranty of liabilities 5.13%