Suzuki 2009 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2009 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUZUKI MOTOR CORPORATION 9

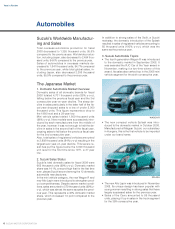

Suzuki’s Worldwide Manufactur-

ing and Sales

Total overseas motorcycle production (including

ATVs) in fiscal 2008 was 2,984 thousand units,

105% compared to the previous year. Worldwide

production, including production in Japan, de-

creased to 3,295 thousand units, 97.2% compared

to the previous year.

Sales of motorcycle (including ATVs) in overseas

market increased to 3,222 thousand units, 101.4%

compared to the previous year, while total global

sales, including Japan, were 3,351 thousand units,

100.2% compared to the previous year.

The Japanese Market

1. Domestic Motorcycle Market Overview

The number of motorcycles sold for the domestic

market by the four Japanese manufacturers in fis-

cal 2007 stood at a total of 655 thousand units

(96% y-o-y).

Breaking this figure down into displacement cat-

egories shows volume for the 125cm3 and under

class at 534 thousand units (98% y-o-y), and the

126cm3 and greater class at 122 thousand units

(89% y-o-y), a decline in both categories.

While overall sales experienced a downward trend,

sales in the 51cm3 to 125cm3 range increased to

109 thousand units (125% y-o-y) due to the intro-

duction of new products.

2. Suzuki Sales Status

With the affects of the global recession, product

lineup consolidation to conform to emission regula-

tions, and rising vehicle costs, Suzuki’s fiscal 2008

total volume was 123 thousand units (75% y-o-y).

Further breakdown of this figure shows sales of

small scooters at 105 thousand units (76% y-o-y).

Within this figure the volume for the 50cm3 and un-

der class declined to 64 thousand units (64% y-o-y)

while sales of the 51cm3 to 125cm3 class increased

to 40 thousand units (110% y-o-y).

Looking at the figures for larger models, sales de-

clined to 19 thousand units (70% y-o-y). Sales in the

126 cm

3

to 250cm

3

class were 12 thousand units

(62% y-o-y) and in the 401cm

3

and greater class 1

thousand units (59% y-o-y), a drastic decline in both

categories however, sales in the 251cm

3

to 400cm

3

class increased to 5 thousand units (110% y-o-y).

Motorcycles

3. Suzuki Motorcycle Topics

Sales of the Let’s4 and Let’s5 series scooters in the

50cm

3

and under class increased the number of

shipments (Let’s4: 33 thousand units (118% y-o-y),

Let’s5:10 thousand units (165% y-o-y)) however, it

was not enough to halt the overall downward trend

caused by the termination of production of certain

models due to exhaust emissions regulations at

the end of last fiscal year. Regarding the 51cm

3

to

125cm

3

class, introduction of the Address V125,

which underwent a minor change to conform to

regulations, led to an increase in sales of 110%

compared to the previous year.

Regarding larger models, the new Gemma

scooter was introduced in the 126cm3 to 250cm3

class however, it could not stop the decrease in

the number of shipments caused by model elimi-

nation due to exhaust emissions regulations. In the

251cm3 to 400cm3 class, the GSR400/ABS, which

underwent a model change, saw an increase in

sales of 110% compared to the previous year.

Let’s5G

GEMMA

ADDRESS V125G

GSR400 ABS

Year in Review