Suzuki 2009 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2009 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUZUKI MOTOR CORPORATION 33

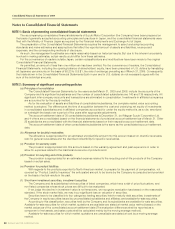

(g) Hedge accounting

Gains or losses arising from changes in fair value of the derivatives designated as “hedging instruments” are

deferred as an asset or liability and included in net profit or loss in the same period during which the gains and losses

on the hedged items or transactions are recognized.

The derivatives designated as hedging instruments by the Company and its subsidiaries are principally interest

swaps and forward exchange contracts. The related hedged items are accounts receivable-trade and investment

securities.

The Company and its subsidiaries have a policy to utilize the above hedging instruments in order to reduce our

exposure to the risk of interest rate and foreign exchange fluctuation. Thus, our purchases of the hedging instruments

are limited to, at maximum, the amounts of the hedged items. The Company and its subsidiaries evaluate effectiveness

of its hedging activities by reference to the accumulated gains or losses on the hedging instruments and the related

hedged items from the commencement of the hedges.

(h) Foreign currency translation

All monetary assets and liabilities denominated in foreign currencies, whether long-term or short-term are translated

into Japanese yen at the exchange rates prevailing at the balance sheet date. Resulting gains and losses are included

in net profit or loss for the period.

Assets and liabilities of the foreign subsidiaries and affiliates are translated into Japanese yen at the exchange rates

prevailing at the balance sheet date.

The components of net assets are translated into Japanese yen at their historical rates. Profit and loss accounts for

the year are translated into Japanese yen using the average exchange rate during the year. Differences in yen amounts

arising from the use of different rates are presented as “foreign currency translation adjustments” and “minority

interests” in the net assets.

(i) Inventories

Cost method mainly by the gross average method (figures on the consolidated balance sheet are by the method of

book devaluation based on the reduction of profitability)

(j) Method of depreciation and amortization of non-current assets

a. Property, plant and equipment (excluding lease assets)

............... Mainly declining balance method (mainly 3-75 years)

b. Intangible assets (excluding lease assets)

............... Straight line method

c. Lease assets

Finance lease which transfer ownership

............... The same method as depreciation and amortization of self-owned non-current assets

Finance lease which do not transfer ownership

............... Straight-line method with the lease period as the durable years. As to remaining value, lease assets

with guaranteed residual value under lease agreement is to be remaining value, and other lease

assets, remaining value zero is applied.

(k) Income taxes

The provision for income taxes is computed based on the income before income taxes included in Consolidated

Statements of Income. The assets and liability approach is adopted to recognize deferred tax assets and liabilities for

the expected future tax consequences of temporary differences between the carrying amounts and the tax bases of

assets and liabilities.

In making a valuation for the possibility of collection of deferred tax assets, the Company and its subsidiaries

estimate their future taxable income reasonably. If the estimated amount of future taxable income decrease, deferred tax

assets may decrease and income taxes expenses may be posted.

(l) Provision for retirement benefits and provision for directors’ retirement benefits

In order to allow for payment of employees’ retirement benefits, based on estimated amount of retirement benefits

liabilities and pension assets at the end of this fiscal year, the allowable amount which occurs at the end of this fiscal

year is appropriated.

With regard to prior service costs, the amount, prorated on a straight line basis over the period of average length of

employees’ remaining service years at the time when it occurs, is treated as expense. As for the actuarial differences,

the amounts prorated on a straight line basis over the period of average length of employees’ remaining service years in

each year in which the differences occur are respectively treated as expenses from the next term of the year in which

they arise.

Consolidated Financial Statements of 2009