SkyWest Airlines 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2009

(10) Retirement Plans and Employee Stock Purchase Plans (Continued)

In February 1996, the Company’s Board of Directors approved the SkyWest, Inc. 1995 Employee

Stock Purchase Plan (the ‘‘1995 Stock Purchase Plan’’). The 1995 Stock Purchase Plan enabled

employees to purchase shares of the Company’s common stock at a 15% discount, through payroll

deductions. There are no additional shares of common stock available for issuance under this plan.

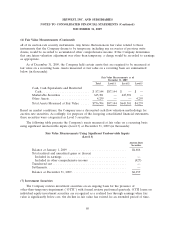

The following table summarizes purchases made under the 2009 and 1995 Employee Stock

Purchase Plans:

Year Ended December 31,

2009 2008 2007

Number of share purchased .................... 835,469 807,797 454,162

Average price of shares purchased ............... $ 10.26 $ 13.90 $ 20.65

The 2009 Stock Purchase Plan is a non-compensatory plan under the accounting guidance.

Therefore, no compensation expense was recorded for the year ended December 31, 2009. The 1995

Stock Purchase Plan was a compensatory plan under the accounting guidance because the shares were

purchased semi-annually at a 15% discount based on the lower of the beginning or the end of the

period price. During the years ended December 31, 2008 and 2007, the Company recorded

compensation expense of $3.0 million and $2.8 million related to 1995 Stock Purchase Plan,

respectively. The fair value of the shares purchased under the Stock Purchase Plan was determined

using the Black-Scholes option pricing model with the following assumptions:

2008 2007

Expected annual dividend rate ............................. 0.80% 0.47%

Risk-free interest rate ................................... 2.51% 5.07%

Average expected life (months) ............................ 6 6

Expected volatility of common stock ......................... 0.264 0.272

(11) Stock Repurchase

The Company’s Board of Directors authorized the repurchase of up to 15,000,000 shares of the

Company’s common stock in the public market. During the years ended December 31, 2009 and 2008,

the Company repurchased 1.9 and 5.4 million shares of common stock for approximately $18.4 million

and $102.6 million at a weighted average price per share of $9.88 and $19.16, respectively.

(12) Related-Party Transactions

The Company’s President, Chairman of the Board and Chief Executive Officer, serves on the

Board of Directors of Zions Bancorporation (‘‘Zions’’). The Company maintains a line of credit (see

Note 2) and certain bank accounts with Zions. Zions is an equity participant in leveraged leases on

three CRJ200, two CRJ700 and five Brasilia turboprop aircraft operated by the Company. Zions also

serves as the Company’s transfer agent. The Company’s cash balance in the accounts held at Zions as

of December 31, 2009 and 2008 was $22.1 million and $11.7 million, respectively.

86