SkyWest Airlines 2009 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2009 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2009

(6) Fair Value Measurements (Continued)

all of its auction rate security instruments. Any future fluctuations in fair value related to these

instruments that the Company deems to be temporary, including any recoveries of previous write

downs, would be recorded to accumulated other comprehensive income. If the Company determines

that any future valuation adjustment was other than temporary, a charge would be recorded to earnings

as appropriate.

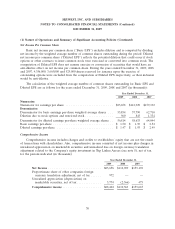

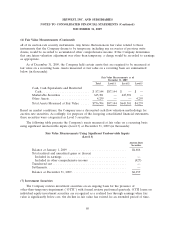

As of December 31, 2009, the Company held certain assets that are required to be measured at

fair value on a recurring basis. Assets measured at fair value on a recurring basis are summarized

below (in thousands):

Fair Value Measurements as of

December 31, 2009

Total Level 1 Level 2 Level 3

Cash, Cash Equivalents and Restricted

Cash ........................... $ 87,144 $87,144 $ — $ —

Marketable Securities ................ 645,301 — 645,301 —

Other Assets ....................... 4,259 — — 4,259

Total Assets Measured at Fair Value ..... $736,704 $87,144 $645,301 $4,259

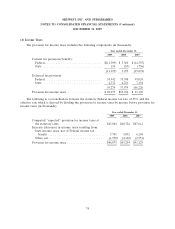

Based on market conditions, the Company uses a discounted cash flow valuation methodology for

auction rate securities. Accordingly, for purposes of the foregoing consolidated financial statements,

these securities were categorized as Level 3 securities.

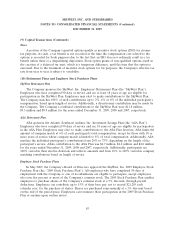

The following table presents the Company’s assets measured at fair value on a recurring basis

using significant unobservable inputs (Level 3) at December 31, 2009 (in thousands):

Fair Value Measurements Using Significant Unobservable Inputs

(Level 3)

Auction Rate

Securities

Balance at January 1, 2009 ................................. $4,686

Total realized and unrealized gains or (losses)

Included in earnings .................................... —

Included in other comprehensive income ..................... (427)

Transferred out .......................................... —

Settlements ............................................. —

Balance at December 31, 2009 ............................... $4,259

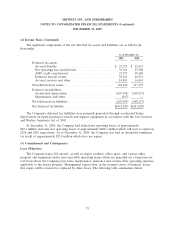

(7) Investment Securities

The Company reviews investment securities on an ongoing basis for the presence of

other-than-temporary-impairment (‘‘OTTI’’) with formal reviews performed quarterly. OTTI losses on

individual equity investment securities are recognized as a realized loss through earnings when fair

value is significantly below cost, the decline in fair value has existed for an extended period of time,

80